The effects of pension policy in the Nordics and Estonia

People retire at a considerably later age in Finland and Denmark than before. In the last decade, these two countries have caught up with the other Nordic countries in this respect. Also in Estonia, people retire at a significantly higher age. In Norway, on the other hand, the effective retirement age has dropped steeply. What pension policy solutions underly the changes?

Several pension policy measures have been taken in the Nordic countries and Estonia. The aim of these measures is to postpone retirement. Raising the old-age retirement age is perhaps the most prominent and significant measure. In addition, early retirement routes and disability pensions have been amended. A comparison by the Finnish Centre for Pensions shows that the measures taken have also impacted the effective retirement ages.

Changes in retirement ages a common denominator in pension reforms

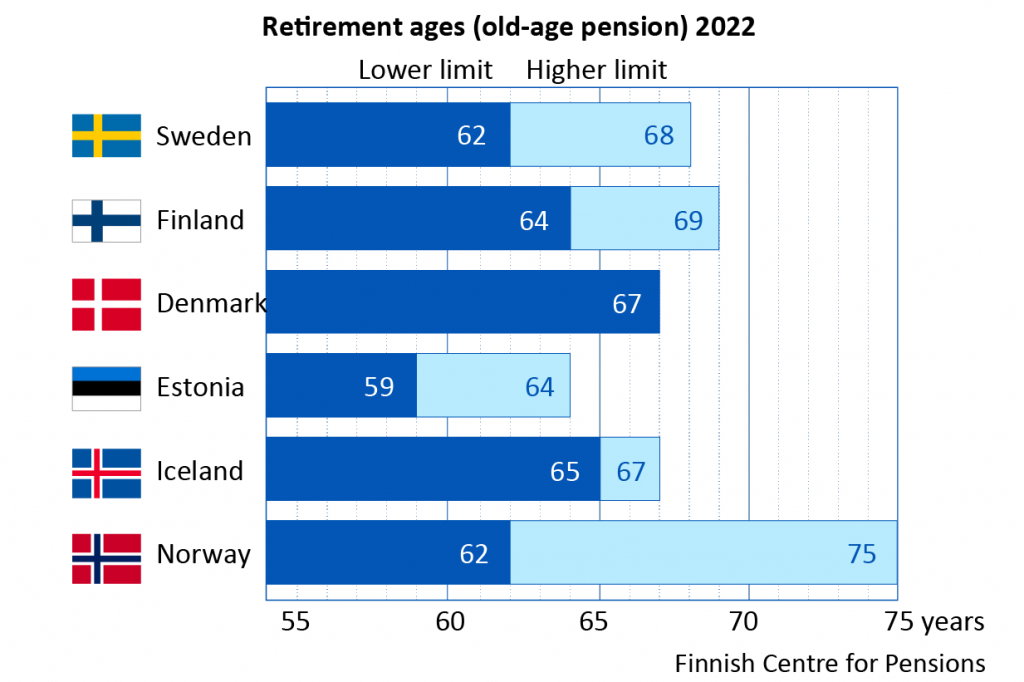

In Iceland, the retirement age has remained unchanged (at 67 years) already for decades. In the other Nordic countries and Estonia, the milestone of retirement has shifted. However, despite the long-term increase in life expectancy, retirement ages have not always been raised. For example, in Denmark, the retirement age was first lowered to 65 years and then restored to 67 years and linked to life expectancy in the period 2013–2022.

Also in Finland, Sweden and Norway, the general retirement age was lowered at the same time as it was made flexible. In Finland, the general retirement age has strongly indicated the age at which people retire. In Sweden, the earliest retirement age has at no point in time caused a rush to retirement.

In Norway, on the other hand, lowering the retirement age from the previous 67 years to the current 62 years has attracted many to retire early. Particularly men have taken advantage of this opportunity and continued working while drawing a pension. Contrary to Finland, Sweden and Estonia, the retirement age has not been raised in Norway.

Routes to early pensions eliminated

People have retired on early pensions in Finland and Denmark more frequently than in the other Nordic countries. In Finland and Denmark, the early pension granted based on unemployment insurance has been a popular exit route from the labour market.

In Finland, the unemployment pension has been abolished and the additional days of the unemployment allowance are about to be abolished. In Denmark, access to the early retirement route via unemployment insurance has been pushed forward along with the rising retirement age. At the same time, the time in early retirement has been shortened, from five years to three years.

In Estonia, the routes to early retirement are many. The required insurance period has been extended, but it is possible to retire on a reduced pension five years before reaching the general retirement age. Early retirement without a reduction can be granted for a maximum of 5 years (depending on how many children one has) or 10 years (based on work that requires great effort). Some early pensions are granted based on profession.

The contractual early retirement (AFP) offered in Norway between the ages of 62 and 67 has been amended to encourage working. It is now a life-long supplementary pension.

At the same time as other routes to early retirement have been abolished, retirement on an old-age pension has been made more flexible via partial pension solutions. The equivalent to the Finnish partial old-age pension exists also in Sweden and Norway. It offers a flexible way to combine working and partial retirement.

Work in line with ability to work

Stricter requirements for receiving a disability pension are among the most prominent features of disability pension reforms. For example, as a rule, disability pensions are not granted to persons under the age of 40 in Denmark. The pensions have been replaced by a fixed-term benefit paid out for the period that the work ability is assessed. The work ability assessment is more lenient for those who have turned 60, as it is in Finland.

The aim of the reforms is to encourage benefit recipients to continue working in line with their remaining ability to work and to not view them as pensioners. For example, benefits corresponding to disability pensions have been transferred to sickness insurance in Sweden and to unemployment insurance in Estonia.

Read more:

- Expected effective retirement age and exit age in the Nordic countries and Estonia. Statistics from the Finnish Centre for Pensions 02/2022 (in Julkari)

- Highest effective retirement age in Sweden – Finland among the top three

- Old-age retirement ages in different countries