Knowing pensions and trust in pension system

Knowing pensions helps people make decisions concerning their own pensions. Knowing pensions also helps people assess the general discussion on pensions and their financing, and to base the assessments on facts.

Trust in the pension system, its future and functionality may also affect the perception of how acceptable pensions are and assessments of one’s own financial situation in retirement.

From the point of view of the functionality and future of the pension system, pension knowledge and trust in the pension system are important research themes.

Our research shows:

- Most Finns consider their knowledge of pensions to be poor or fairly poor. There is also a great deal of uncertainty about the details of pensions.

- In general, the pension system is seen as reliable but, when looking in more detail, there are concerns about how well the pension system works and what its future is.

Knowing pensions

Surveys show that few Finns feel that they know pensions well. Some of the details relating to the pension system are well known while others are not.

Pension knowledge can be approached through perceived levels of knowledge or from the perspective of detailed knowledge.

Few assess that they know pensions well

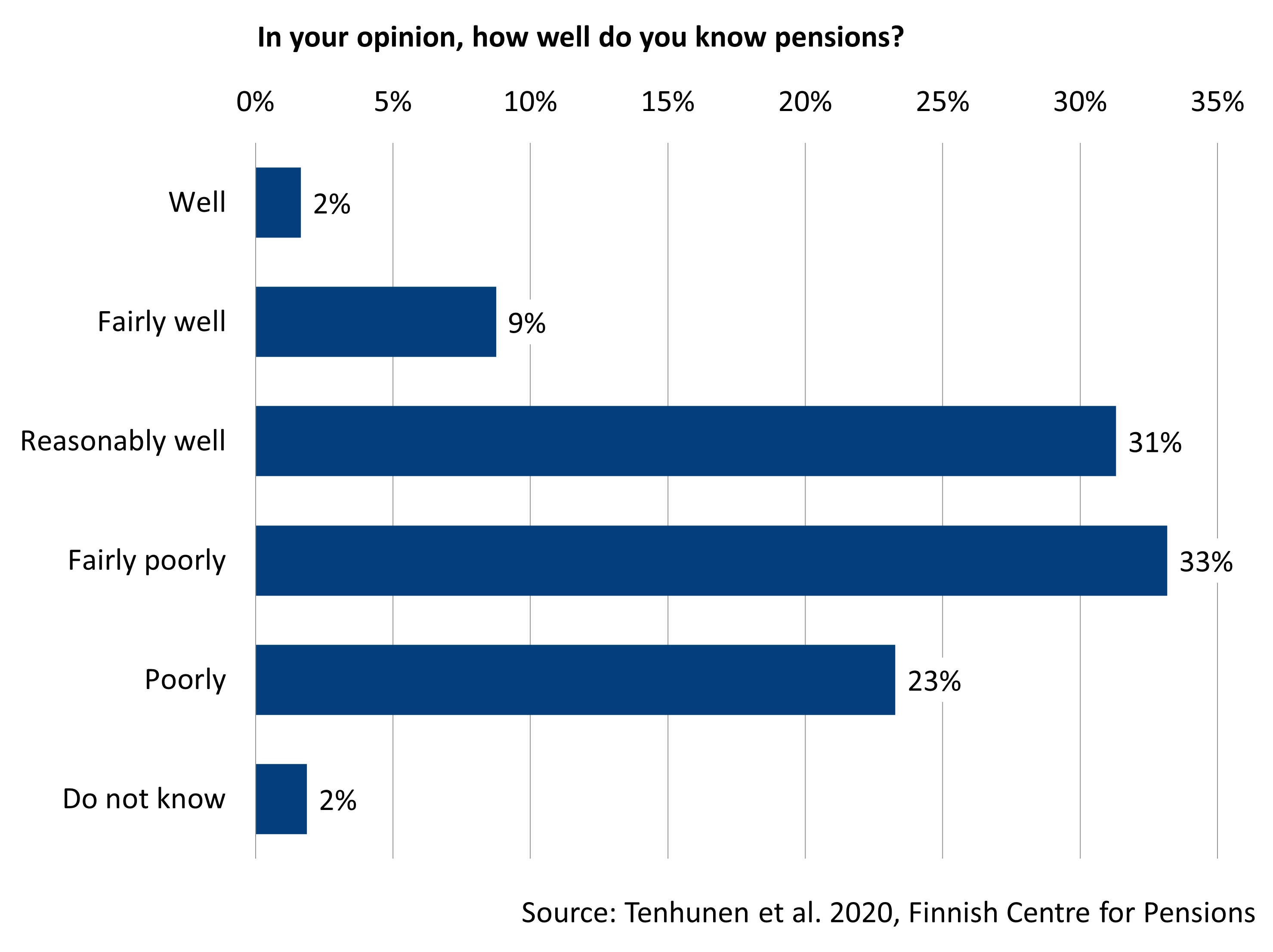

The 2019 survey on views on pensions examined the pension knowledge of 25–67-year-olds. More than half of the respondents felt that they know pensions poorly or fairly poorly. Every ninth respondent assessed that they know pensions well or fairly well.

The 55–67-year-olds, the self-employed and pensioners felt that their knowledge of pensions is better than average. Women, the 25–34-year-olds, those with a basic education and those in low-income households estimated that their knowledge of pensions is poorer than average.

Previous surveys (in 2011 and 2014) explored people’s knowledge of the national and the earnings-related pension system. At that time, nearly half of the respondents assessed that they know the pension system poorly or fairly poorly. Less than one fifth of the respondents assessed that they know the national and the earnings-related pension system well or fairly well.

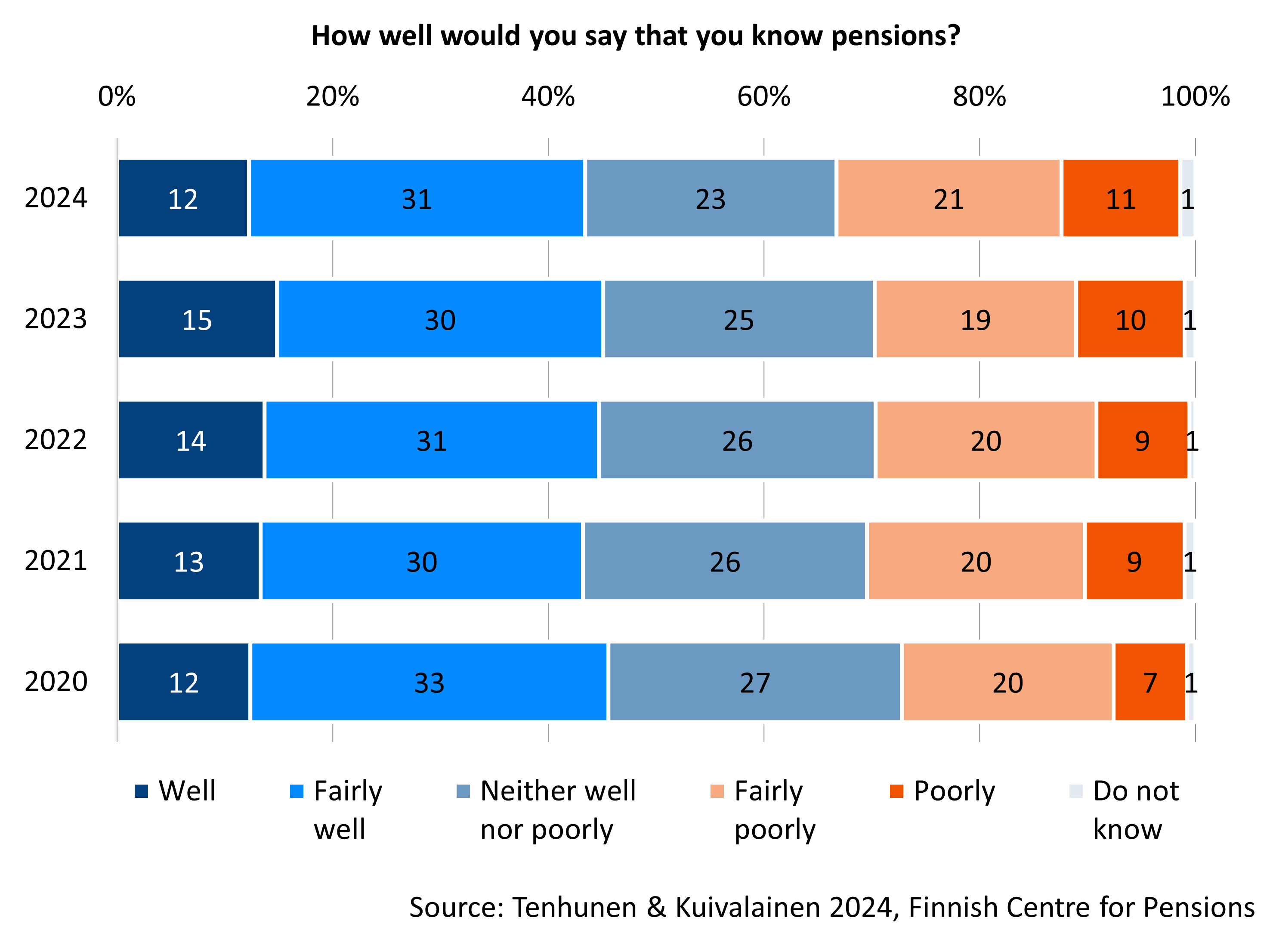

Pension knowledge has also been assessed through the Pension Barometer, an annual survey in which persons aged 18 or older are asked about their views on pensions. Between 2017 and 2020, the perceived knowledge of pensions improved. After that, it has remained at an even level.

The share of persons who assess that they know pensions well or fairly well has levelled out at around 45 per cent of the respondents. 30 per cent of the respondents assess that their knowledge of pensions is poor or fairly poor. Older respondents, in particular, feel that they know pensions better now than before.

Publications:

- Tenhunen et.al. 2020. Miten hyvin eläkeasiat ja vuoden 2017 eläkeuudistus tunnetaan? Kyselytutkimus eläketurvaan liittyvistä näkemyksistä (Julkari)

- Tenhunen & Kuivalainen 2024. Pension Barometer 2024 (Julkari)

New pensioners are often aware of the increment for late retirement and the life expectancy coefficient

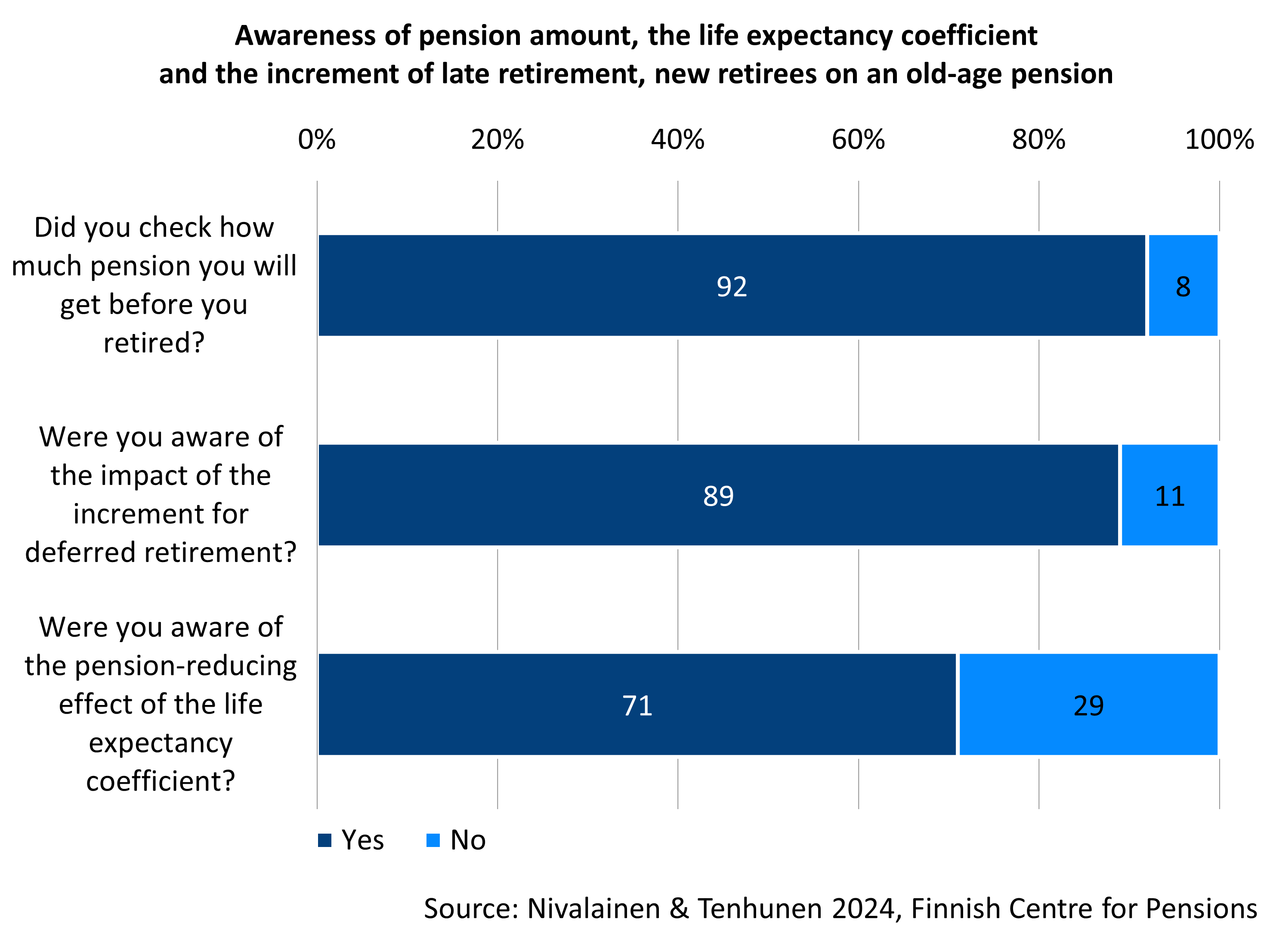

Knowledge of pension issues becomes relevant as retirement approaches. At that time, many also find out who much pension they have accrued and how the timing of retirement affects that amount.

The results of a survey among persons retiring from work revealed that persons who have recently retired on an old-age pension are largely aware of their pension amount and how the increment for late retirement and the life expectancy coefficient affect their pension amount. About nine in ten said that, before they retired, they had checked how much pension they would get. Equally many said they were aware of the effects of the increment for late retirement. The respondents with a higher education were more often aware of these matters than were those with a lower education.

The life expectancy coefficient that came into force as of the beginning of 2005 reduces the monthly pension in line with increasing life expectancy. Seven in ten newly retired on an old-age pension from employment said they were aware of the life expectancy coefficient and its cutting effect on their pension. Men were slightly more often aware of the effects of the life expectancy coefficient than women.

Publications:

Surveys have been conducted to map the knowledge of details of the pension system. Finns know that the retirement age for the old-age pension varies and that a lion’s share of the pension contributions are used to finance pensions. Yet only few know, for example, how much is withheld from their monthly wage in pension contributions.

Varying degrees of knowledge of features of the pension system

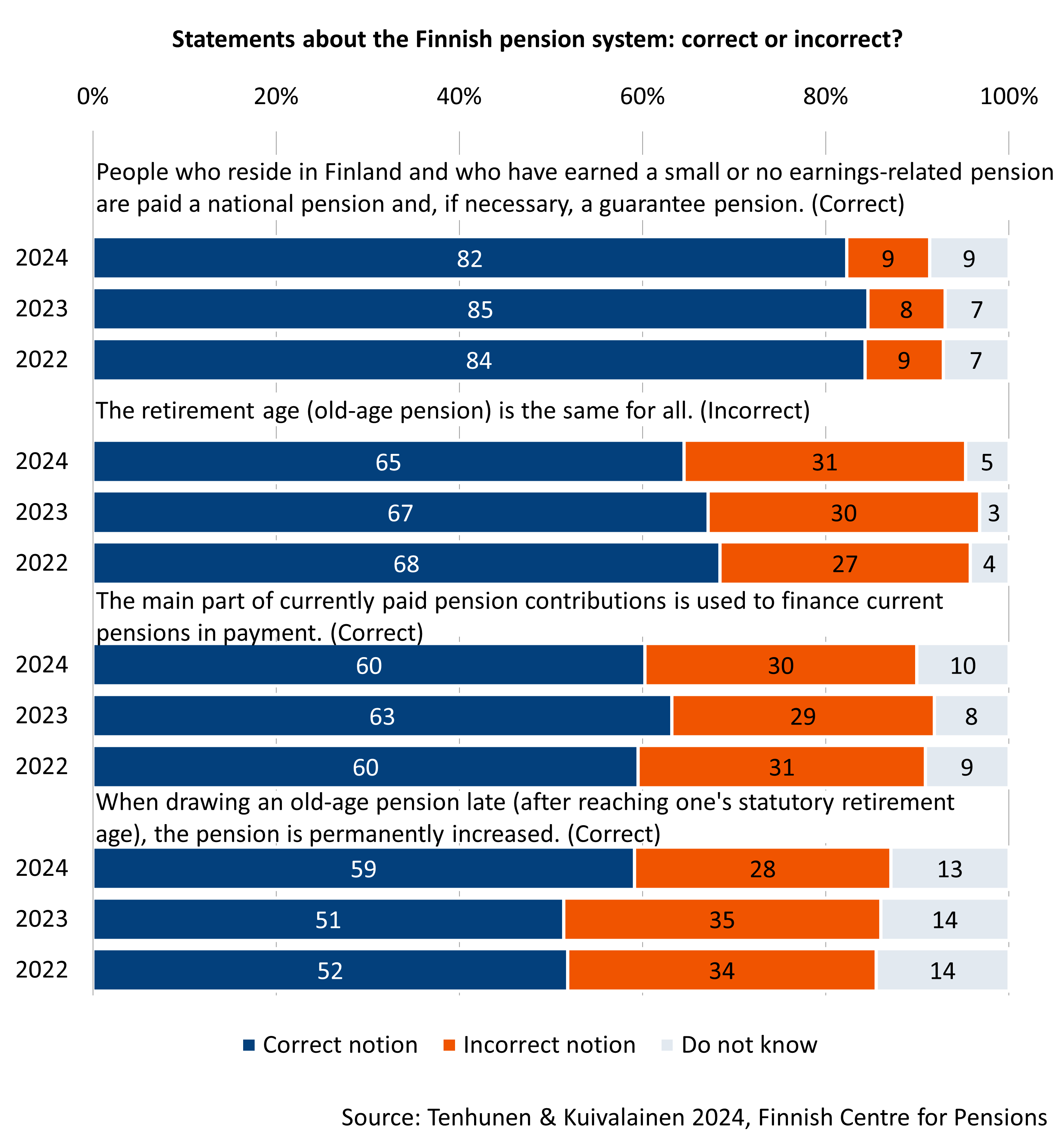

The Pension Barometer measures Finns’ knowledge of pensions with four statements concerning details of the pension system. Some of the statements are correct while others are incorrect.

Most statements were identified correctly as either true or false. The best known statement was about the right to a minimum pension. It was known by almost four in five.

Slightly less than two in three Finns aged 18 or older knew that the retirement age for the old-age pension is not the same for all (it varies by year of birth) and that a lion’s share of the currently paid pension contributions is used to finance pensions in payment at the moment. Less than one third of the respondents had an incorrect notion of this matter.

More than half of the respondents knew that taking out the old-age pension after reaching the statutory retirement age permanently increases the pension amount. This share has increased from previous years.

The 2019 survey on views on pensions also examined pension knowledge with similar questions. Best known in that survey were the statements on the retirement age for the old-age pension, the impact of self-employed persons’ confirmed income and how pension contributions are used. Unemployed person’s right to the partial old-age pension and whether pension accrues for periods of childcare at home and studies were less well known.

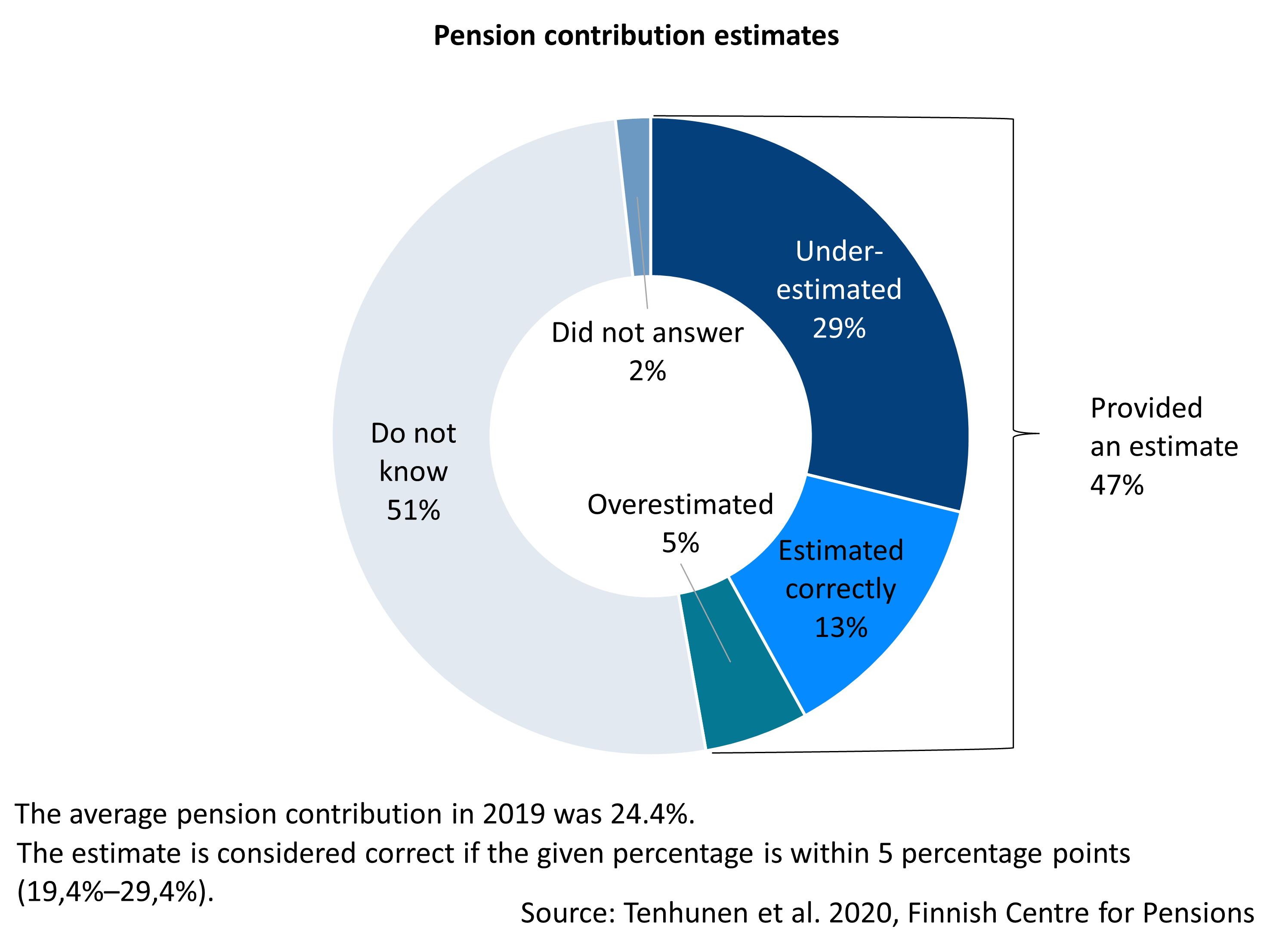

More than one in ten Finns could assess the pension contribution level correctly

In the 2019 survey on views on pensions, the respondents were asked to assess how many per cent of their wage or, if self-employed, of their income from self-employment a worker and their employer together pay in pension contributions. More than half of the respondents said that they do not know. A majority of those who provided an assessment underestimated their pension contribution level. Of all respondents, 13 per cent provided an accurate estimate (with +/- 5 per cent error). In 2019, the average combined employee and employer contribution was 24.4 per cent.

Those with a higher income and the self-employed were more often correct in their estimates of the contribution rate than the others. On average, men and those with a higher than basic education more often gave incorrect estimates. Women, those with a basic education and those in low-income households were more often uncertain.

Publications:

- Tenhunen et.al. 2020. How familiar are Finns with pension issues and the 2017 pension reform in Finland? Questionnaire survey on views relating to pensions (Julkari, summary in English)

- Tenhunen & Kuivalainen 2024. Pension Barometer 2024 (Julkari)

Read more on Etk.fi:

Trust in pensions

Trust in pensions has many aspects. It can be assessed not only in terms of the general reliability of the pension system, but also in terms of the content of pension provision.

As a rule, Finns trust the pension system

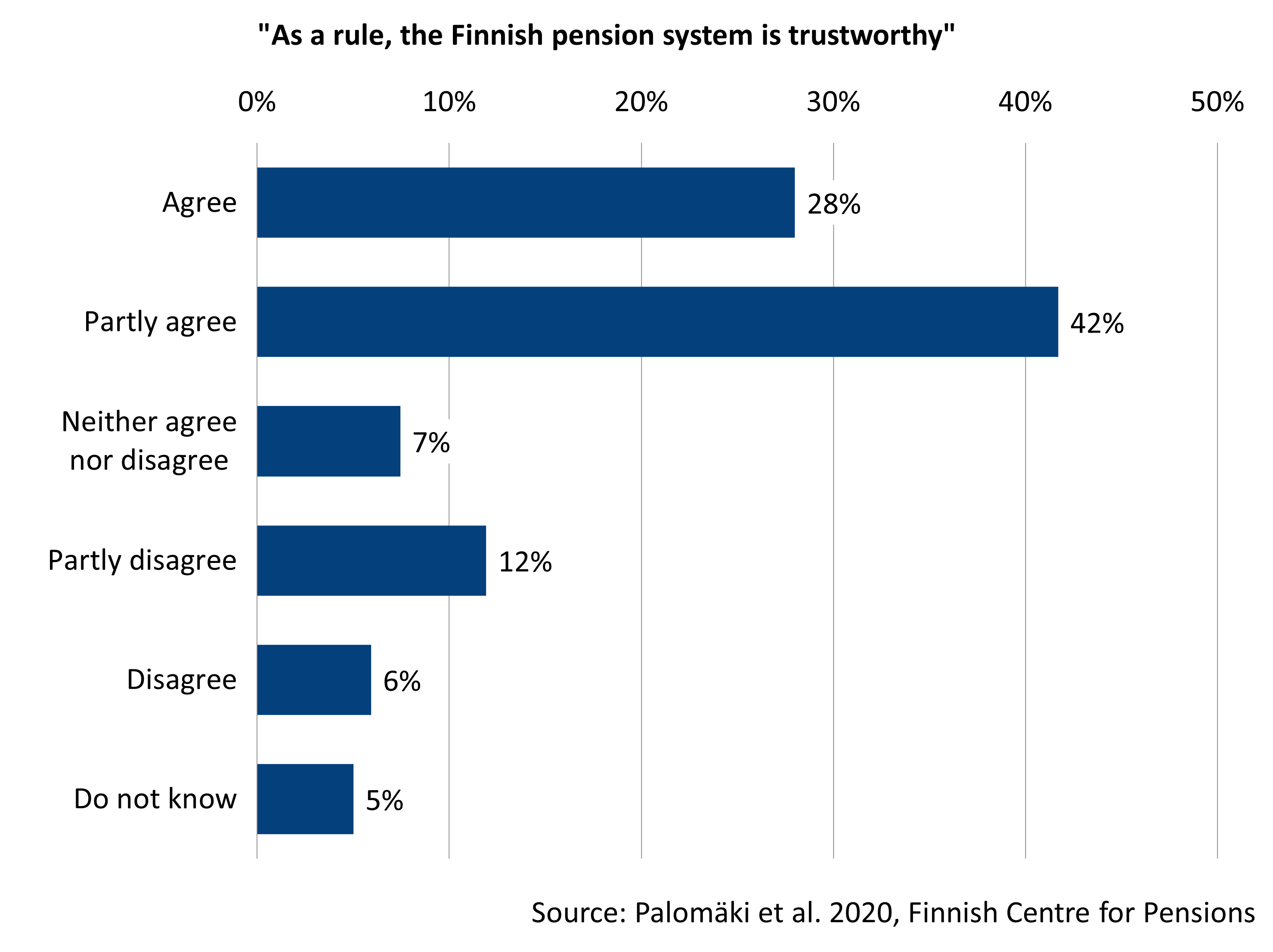

According to the 2019 survey on views on pensions, more than 70 per cent of 25–67-year-olds found the Finnish pension system to be trustworthy.

The over-55-year-olds and those with a tertiary degree trusted the system more often than others. The under-45-year-olds, those living alone and those who felt in poorer health, on the other hand, were more critical.

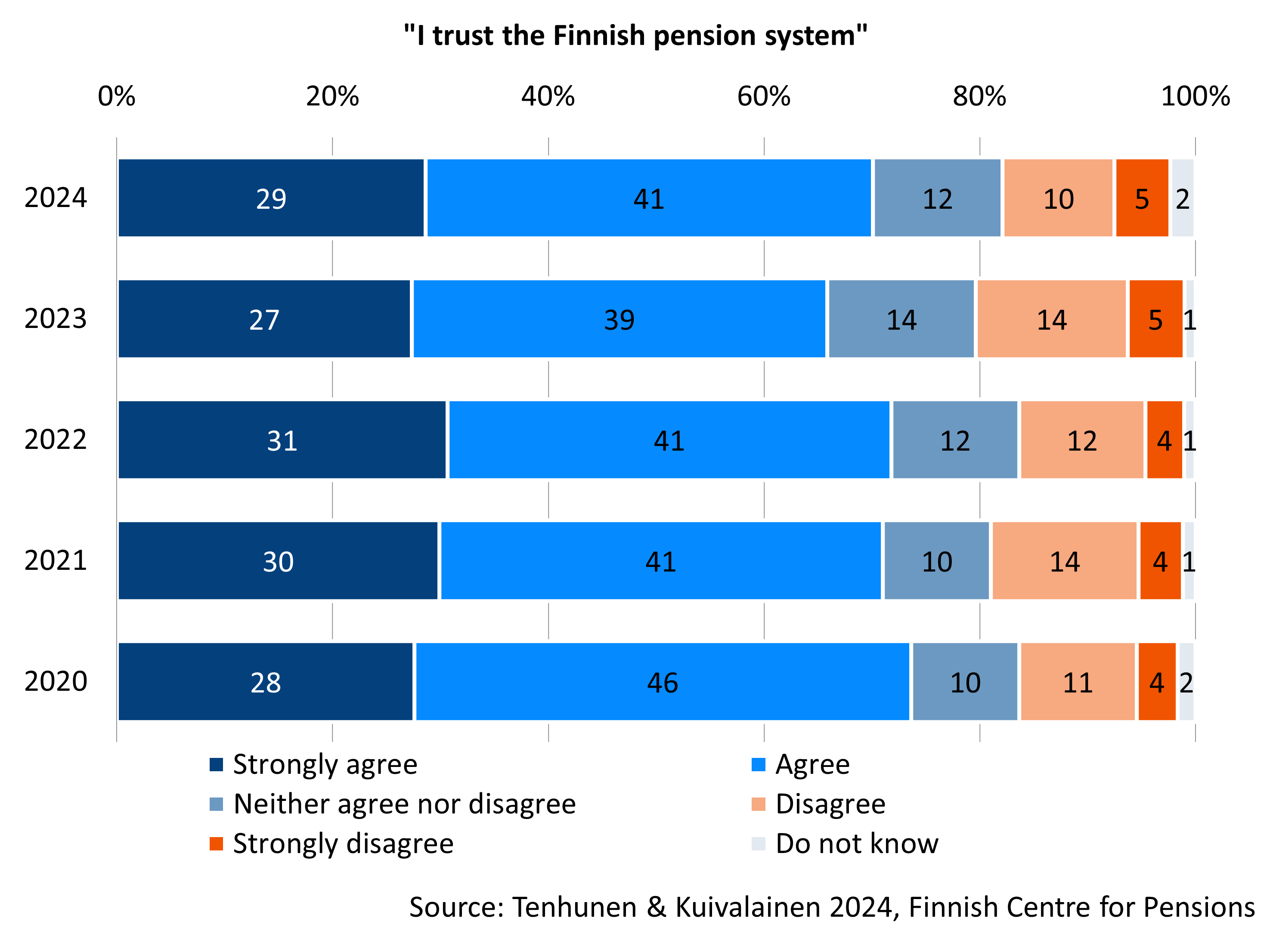

Trust in the pension system is also measured via the annual pension barometer. According to the survey, nearly three in four 19–79-year-olds had a positive view of the reliability of the pension system. Men and older respondents trusted the pension system more often than others.

Over the past five years, the share of respondents with a positive view of the reliability of the pension system has been around 70 per cent. The share of respondents with a critical view has remained at more than 20 per cent.

Trust in pensions can be influenced by experiences of continuity and inequality

Based on the open-ended responses from the 2014 survey ”Trust in the pension system” and the 2019 survey ”Views on Pensions”, confidence in pension security can be based on different factors for different people. These factors include, firstly, the reliability of the system’s operation; secondly, the outcome of pension security, that is, the adequacy and fairness of pensions; and thirdly, factors external to the system itself.

Factors that seem to increase confidence include experience of the stability and continuity of the pension system, the system’s transparency and adequate information, as well as general confidence in the Finnish social structure and institutions.

Factors that appear to reduce confidence include experiences of inadequate pension levels and inequality, an ageing population and uncertainty about the economic situation and political decision-making.

Publications:

- Liukko 2016. Mikä lisää ja mikä vähentää luottamusta eläketurvaan? (What increases and what decreases trust in pensions?) (Julkari)

- Liukko & Palomäki 2024. Luottamus instituutioihin ja lakisääteinen eläketurva [Trust in institutions and statutory pensions] (Julkari)

- Palomäki et.al. 2021: Trust in the pension system 2019: Questionnaire survey on views relating to pensions (Julkari, summary in English)

- Tenhunen & Kuivalainen 2024. Pension Barometer2024 (Julkari)

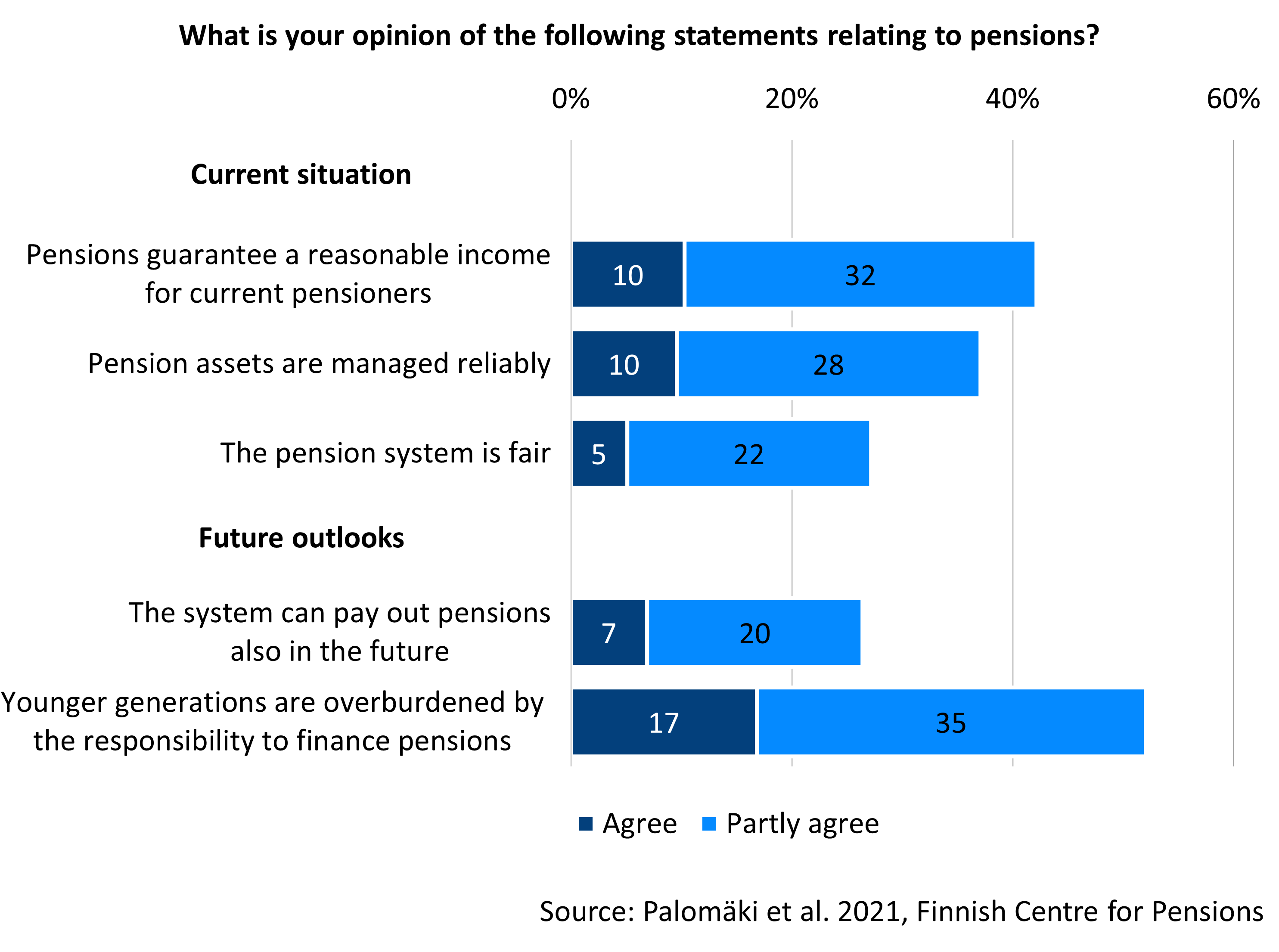

In the 2019 survey on views on pensions, we mapped the views on the current pension system and its future. The views were divided on several questions.

Views on current status of the pension system vary

Slightly less than half of the respondents found that pensions ensure a reasonable income for current retirees. Nearly as many were critical about the adequacy of pensions.

An ample one third felt that pension assets were managed reliably, while one quarter disagreed fully or partly.

Only around one quarter of the respondents found the pension system to be fair, while nearly half disagreed.

Men, those with a higher education and those who perceive they are of good health were more positive towards the current status of the pension system than the others. The views of the current status of the pension system did not differ between the age groups. Pension asset management was trusted more often by high-income persons than by others. More often than others, pensioners perceived the pension system to be fair.

Future of pension system less trusted than the current situation

Only an ample one fourth of the respondents assessed that the system will be able to pay pensions in the future, and more than half felt that the payment burden of the young is too high.

Women, the young and those who perceived their health to be poor were more critical towards the pension system’s ability to pay pensions. The young and the respondents who did not have children were more often worried about the payment burden of the young.

Publications:

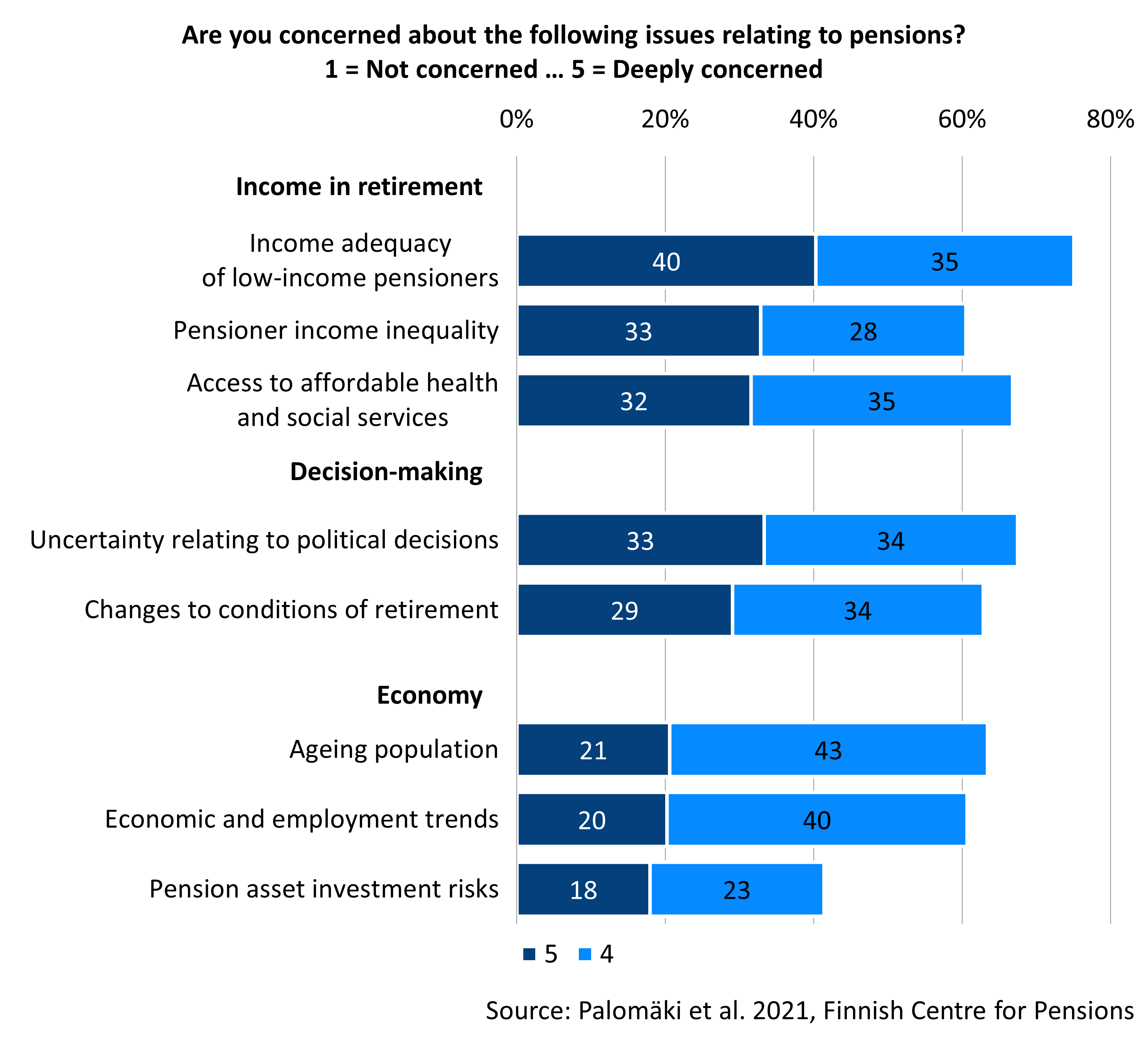

Several questions about income, decision-making and economic outlook are connected with the operations of the pension system. Trust in the pension system can be measured also through concerns about these issues.

Income concerns the most

Factors relating to income in retirement causes most concern. Three in four of the respondents of the 2019 survey on views on pensions were at least somewhat worried about the livelihood of low-income pensioners. Around two in three were worried about access to affordable social and health services.

Slightly less than two in three respondents were concerned about the uncertainty surrounding the conditions of retirement and political decision-making, the ageing of the population and developments in the economic and employment situation. Least concern was caused by the risks relating to pension asset investments.

As a rule, men and those who perceived that they were in good health were less concerned than others regarding all presented statements. The young and those with a tertiary degree, on the other hand, were less often worried about income in retirement and risks relating to pension asset investments..

Publications: