TyEL assets and cash flows

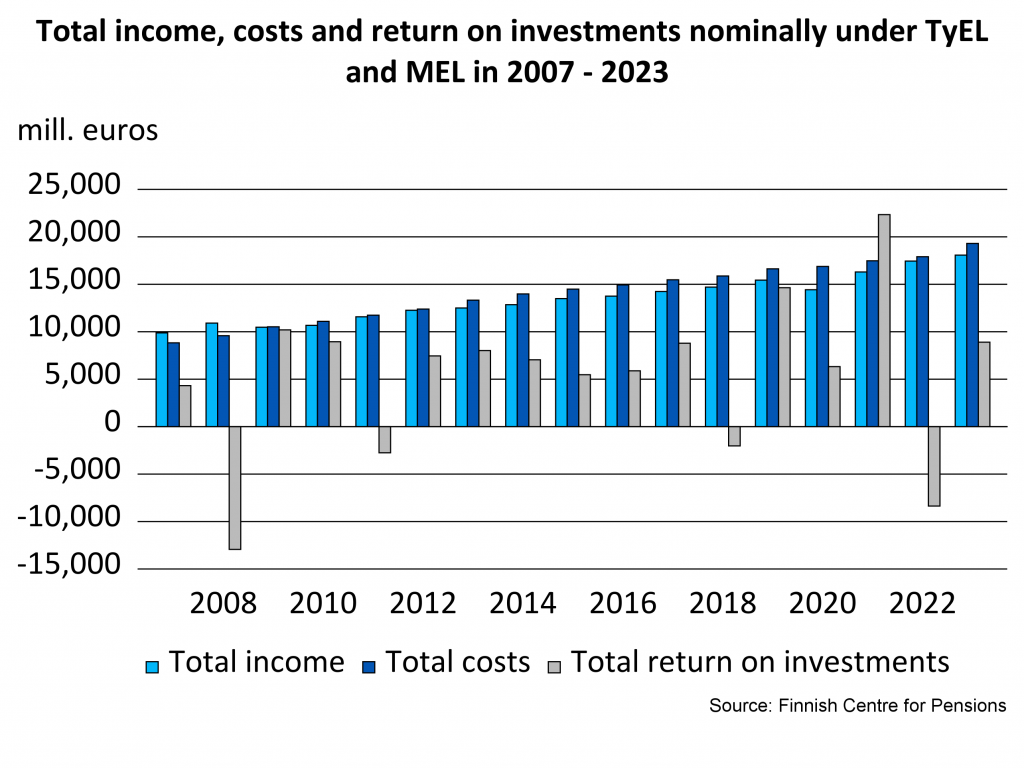

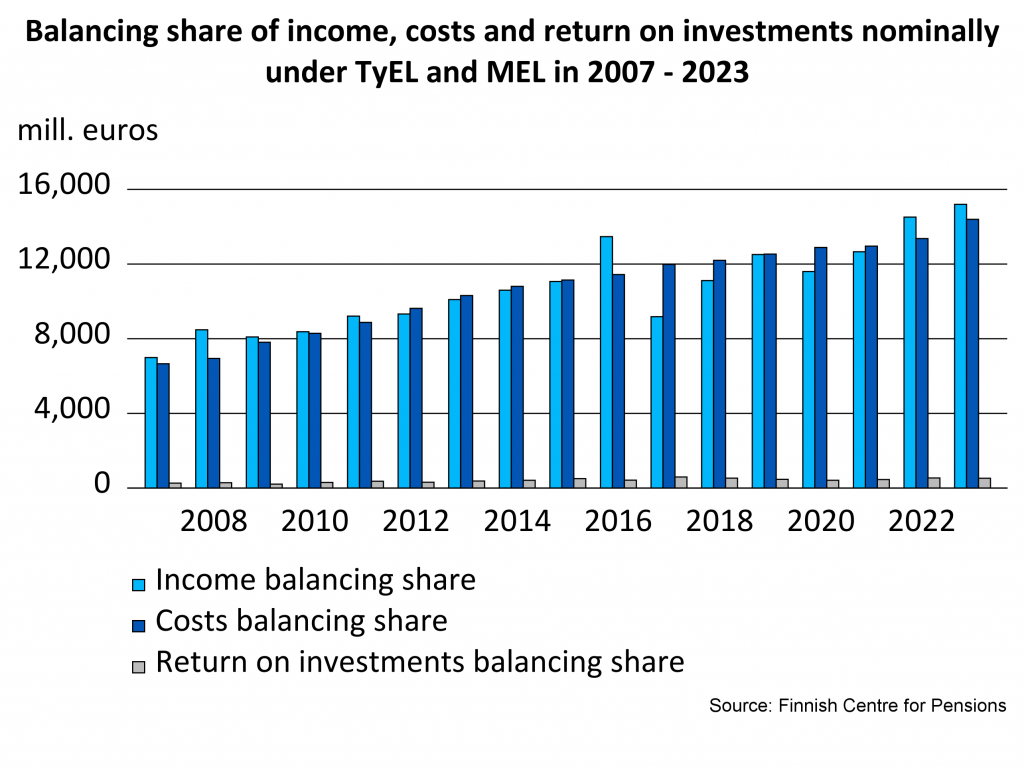

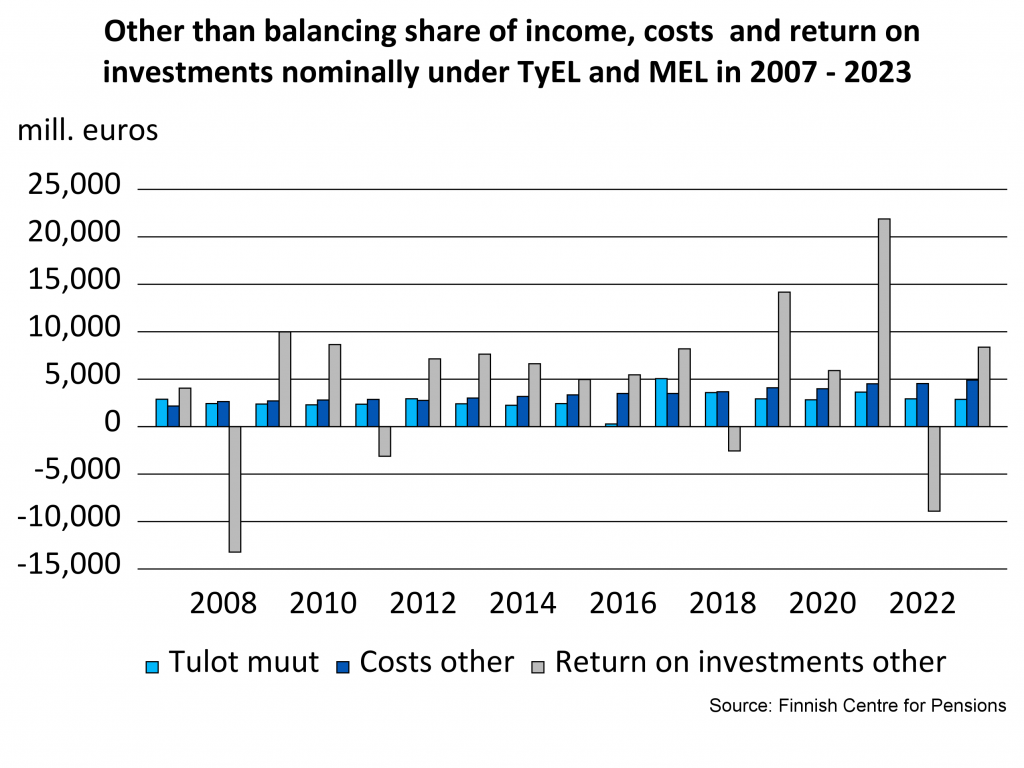

In Finland, the earnings-related pension scheme is diversified, with several actors in the private as well as the public sectors. TyEL and MEL earnings-related pensions are financed according to the pay-as-you-go (PAYG) principle. For the main part, the pensions paid out in a given year are financed with the pension contributions paid that year. The remaining part is financed with the investment return of the funded pension components. The TyEL and MEL pension schemes are partly funded and the buffer fund of the PAYG share is the provision for pooled claims. Bigger part of TyEL and MEL income and costs are covered from the balance share than from the funds.

In the table, the cash flow for TyEL and MEL earnings-related pension scheme has been divided into nine parts according to the financing technique old age, disability, unemployment, pooling, equity-linking, supplementary pension security, bonuses and rebates and solvency capital.

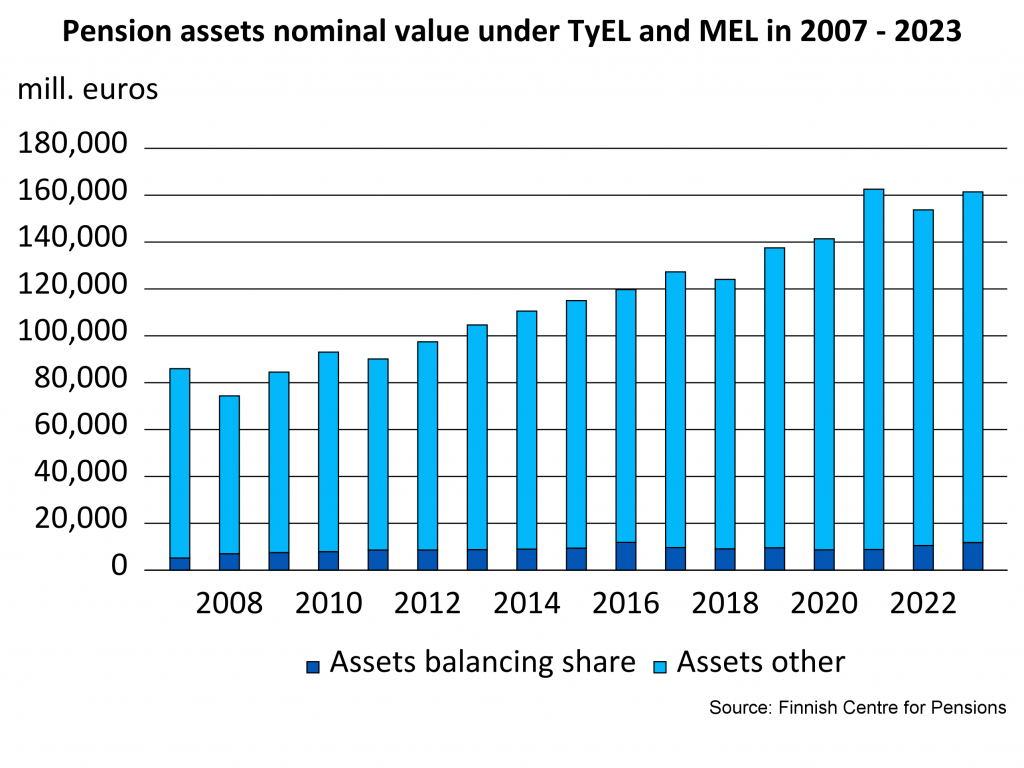

The earnings-related pension system’s assets under TyEL- and MEL increased in 2023 with 7 670 million euros. Total assets at year-end were 161,410 million euros.

(Updated on 30 Aug 2024)

Statistical tables:

TyEL assets and cash flows

Producer: Finnish Centre for Pensions

Website: TyEL assets and cash flows

Subject area: Financing and Insurance

Part of the Official Statistics of Finland (OSF): No

Description

In Finland, the earnings-related pension scheme is diversified, with several actors in the private as well as the public sectors. TyEL and MEL earnings-related pensions are financed according to the pay-as-you-go (PAYG) principle. For the main part, the claims paid out in a given year are financed with the pension contributions paid that year. The remaining part is financed with the investment return of the funded pension components.

Data content

In the table, the cash flows for TyEL and MEL assets, insurance contributions, state share, investment profits, claims paid, total operating expenses, taxes have been divided into nine parts according to financing technique. The review begins with the pension assets at start of the year, to which income is added and costs subtracted, resulting in the pension asset sum at year-end. The table also contains a ‘Difference’ column, which balances the figures based on financing technique with the financial statement figures. The differences are due to the fact that the financial statements are prepared at the turn of the year, when the available figures are partly estimates. The cost division is made in autumn the following year, on the final figures.

Categorizations

Pension scheme TyEL and MEL.

Methods of data collection and source

The pension providers have delivered the data mainly electronically.

The financial statements of the pension providers and the cost division data that the pension providers have delivered to the Finnish Centre for Pensions.

Update frequency

Once a year.

Time of completion or release

In October following the statistical year.

Time series

The statistical data is available from 2007 onwards.

Key words

Pension assets, insurance contributions, state share, investment profits, claims paid, total operating expenses, taxes.

Concepts and definitions

In the table, the cash flow for TyEL and MEL have been divided into parts according to financing technique. The column ‘Total’ corresponds to the larger cash flow statistic, where statistical figures have been collected from the financial statements of the pension providers. Cash flow according to financing technique has been divided into nine different parts, and the figures have mainly been collected from the data used in cost division and reported by the pension providers to the Finnish Centre for Pensions. The table also contains a ‘Difference’ column, which balances the figures based on financing technique with the financial statement figures. The differences are due to the fact that the financial statements are prepared at the turn of the year, when the available figures are partly estimates. The cost division is made in autumn the following year, on the final figures.

Classifications

The cash flows are according to the pension scheme TyEL and MEL.

The cash flow components

Old age

In the TyEL and MEL pension schemes, some old-age pensions are funded at the pension level. The technical provisions that are formed are calculated on technical bases using a three per cent discount rate. The technical provisions are calculated on starting old-age pensions as well as future old-age pensions. The technical provisions follow the cost division here.

The insurance contribution corresponds to insurance contributions collected from the funded shares of accrued old-age pensions for each year. The figure has been calculated from the wage sum based on the cost division, with the help of age and gender-specific wage distributions available from the registers.

Transfers comprise the annual fund supplements made to the old-age pensions as well as the mortality instalment coming from or going to the pension pool of the LEL insurance portfolio, based on specific Etera criteria. The old-age pension fund supplements are increases made at the end of the year, covered by accumulated funds. The figure is the sum of the cost division data.

Claims paid correspond to the funded shares of old-age pensions paid in the year in question. The figure is in line with the cost division.

The investment profit is a three per cent interest on the technical provisions and its cash flows. The interest has been calculated based on the figures of the statistic.

The ‘Other’ item is notional, which is partly explained by the results of the insurance business. The item also includes a possible error due to the difference between statistical figures. The result of the insurance business is a consequence of the fact that the mortality basis used when calculating the technical reserves differs from the actualized.

Disability

Disability pensions and rehabilitation allowances in the TyEL and MEL pension schemes are financed at the pension level once the individual pension is granted. Prior to this, preparations are made for disability pensions with a so-called corresponding technical reserve for disability pension, as well as with a so-called claims provision for unknown pensions. In the statistic, the technical reserves of disability pensions are in line with the cost division.

The insurance contribution is the amount the pension providers annually collect from the insurance holders and which are used to cover the costs that arise from funding disability pensions. The insurance contribution has been calculated on the wage sum based on cost distribution, by multiplying it with the average disability tariff and taking into account any temporary discounts.

Claims paid are the funded shares of disability pensions and rehabilitation benefits paid each year. The figure is in line with the cost division.

The costs arising from granting a disability pension are covered with the disability share of the insurance contribution, according to the technical bases. These costs are included in the overall operating costs in the cash flow. The total operating costs also include costs for maintaining working capacity. The statistical figures have been collected from the financial statements data of the pension providers.

Investment income is an interest rate calculated on the figures of the statistic using a three per cent interest rate.

The ‘Other’ item is notional, which is partly explained by the results of the insurance operations. The item also includes a possible error due to the difference between statistical figures. The results of the insurance operations are due to the fact that the costs of financing disability pensions are not always known when determining insurance contributions.

Unemployment

Unemployment pensions are no longer granted from the pension scheme, as unemployment security has been wholly transferred to the unemployment security scheme. Unemployment pensions that were granted previously and still are in payment have been funded similarly to the disability pensions. The last unemployment pensions ended in 2014. The figures of the statistic have been arrived at in a similar way as for the disability pensions.

Pooling

The TyEL and MEL pension schemes are partly funded and the buffer fund of the PAYG share is the provision for pooled claims. The provision for pooled claims is determined based on the technical bases of the pension providers. The figure corresponds to that used in cost division.

The insurance contribution is the combined number of pooled components of the insurance contributions, and is in line with the cost division.

The Employment Fund pays the TR contribution to the earnings-related pension scheme. The contribution is determined based on benefits received from periods of unemployment and education, as well as alternation leave, according to how earnings-related pension is accumulated on the benefits in question. The TR contribution has been calculated from the wage sum according to cost division by multiplying it with the cost division “q” factor.

Transfers include instalments going to old-age pensions. Transfers also include an instalment from supplementary pension security, and instalments possibly returning from the bankrupt estate of Pension Kansa and Garantia. The figure is the sum of data in the cost division.

Claims paid include those of TyEL and MEL benefits mutually paid during the year in question for benefits accrued during unsalaried periods, to the degree that the relevant providers partake in them. The pension providers also participate in the payment of jointly paid supplementary security benefits. The figure corresponds to that used in cost division.

The investment profit is calculated based on the currently valid technical rate of interest and has here been calculated based on the statistical figures.

Equity-linking

The equity risk of investments in the TyEL and MEL schemes are partly shared collectively. For this reason, pension providers have a so-called equity-linked supplementary insurance liability. It is determined based on calculation principles, and fund transfers are made to old-age pension liabilities if it exceeds five per cent of the technical reserves used in the solvency calculation. The figure corresponds to that used in cost division.

The investment profit is an interest determined based on the average collective equity-linked buffer fund of the pension providers. The interest has been calculated on the figures of the statistic.

Supplementary pension security

Some of the TyEL pension providers insure supplementary TEL pension security and employer insurance. Supplementary pensions are partly funded and the technical provisions are calculated based on technical bases. The technical provisions also include a provision for pooled claims, in other words a buffer fund by which to protect against fluctuations in insurance operations. The figure is in line with the cost division.

The supplementary insurance contribution corresponds to the premium income and is in line with the cost division.

Transfers include the pooled component of the insurance contributions and the three per cent exceeding share of the technical rate of interest calculated on the technical provisions. The transfer is determined based on calculation principles and is pooled. The transfer covers the costs of supplementary benefits jointly paid for in the pooling. The transfer is in line with the cost division.

In the cost division, claims paid correspond to funded benefits paid during the year in question.

Overall business costs have been calculated from the other figures of this statistic. They are calculated for the insurance contributions based on the calculation principles, and are loads reserved for the technical reserves.

The investment profit is an interest rate calculated on the statistical figures by a technical rate of interest without taking into account the equalisation provision on which a three per cent interest rate has been calculated.

The instalment ‘Other’ is notional here, partly due to the transfer to solvency margin as a result of exceeding the upper limit of the equalisation provision. The item also includes a possible error due to the difference between statistical figures.

Bonuses and rebates

TyEL pension providers transfer the investment profits and surplus expense loading from the solvency margin to the provision for current bonuses. The transfer takes place within the limits allowed by the technical bases. The provision for current bonuses is a mechanism created for bonuses and rebates and follows the cost distribution data.

The bonuses and rebates of TyEL providers are covered from the provision for current bonuses. The bonuses and rebates are distributed among insurance holders as discounts on the insurance contributions. The bonuses and rebates have been calculated from the voluntary provisions of the previous year as listed in the statistic, with a six-month technical rate of interest.

The transfer is a voluntary provision collected at year-end from the financial statements of the pension providers.

The investment profit is an interest rate calculated on the statistical figures. It corresponds to half a year’s technical rate of interest.

The instalment ‘Other’ is notional due to differences between statistical figures.

Equalisation amount

TyEL providers and funds have an equalization amount by which to protect against swings in the insurance operations. The equalization amount is an equalization provision based on technical bases that contains the old-age, disability and unemployment pension operations and the contribution loss. The equalization amount has been collected from cost distribution data.

At the beginning of 2017, the equalisation amount, was incorporated in the provision for future bonuses.

For the TyEL providers, the insurance contribution is the result of the contribution loss created during the year. The figure has been calculated using wage sums based on cost distribution, contribution losses collected from financial statements and a division based on insurance size received from register data.

The interest rate of the equalization amount is according to the technical bases and is, depending on the statistical year, either a technical rate of interest or a three per cent fund interest. The interest has been calculated on the figures of the statistic.

The instalment ‘Other’ is notional, mainly due to the result transferred to or from the old-age and disability pension funds or the insurance operations released from there.

Solvency margin

The solvency margin acts a buffer against fluctuations in the investment operations of pension providers and also e.g. the insurance of company pension funds. The solvency margin corresponds to the amount left once the technical provisions of the old-age, disability, unemployment pensions and the equalization, equity-linked buffer funds, supplementary security, compensation and the equalization provision have been deducted from the statistic.

The insurance contributions contain the expense loading share of the insurance contribution, as well as the statutory share and the discounts/increases in the contributions of company pension funds and industry-wide pension funds. The figure has been calculated from cost of division data, using the average shares of the insurance contribution.

Transfers contain a financial statements instalment transferred to the provision for current bonuses.

The State share contains the State share of MEL pensions, which is a third of the pension expenditure accrued according to MEL.

Claim paid are MEL surpluses of cost divisions paid during the year in question.

Overall operating costs are costs according to the financial statements, excluding costs to be covered from the disability funds.

Investment profit has been calculated from the net investment profit of financial statements data, by deducting the fund transfer obligation. The fund transfer obligation here is the interest on the technical provisions for old-age pensions, disability pensions, unemployment pensions, pensions paid out of pool, collective equity-linking, supplementary security, compensations and the equalization provision.

Instalment ‘Other’ is notational, due to e.g. the share in the results of company and industry-wide pension funds that is not taken into account in the equalization provision. The instalment also includes an item that is the result of possibly exceeding the upper limit of equalization provision for supplementary security, as well as of differences in the statistical figures.