€258 billion – Pension assets grew considerably in 2021

Pension assets increased by 33 billion euros last year, particularly due to a robust return on pension providers’ investments. Pension contribution income also developed favourably due to the growing wage sum. Low inflation curbed expenditure.

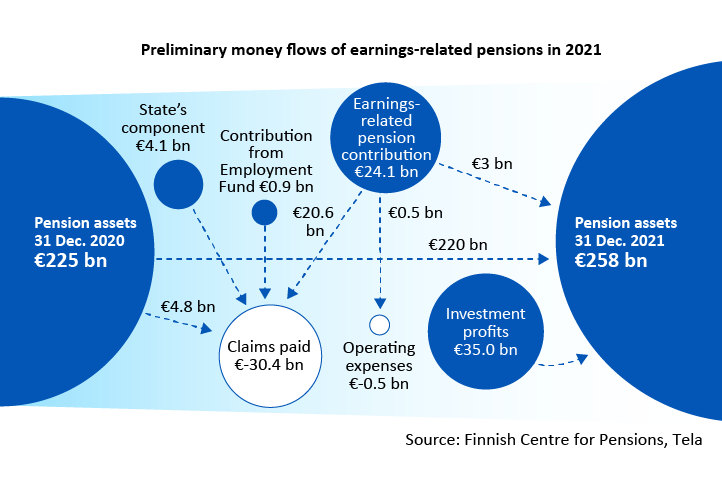

Earnings-related pension expenditure (€31 billion) exceeded revenue (€29 billion) in 2021. Return on investments showed an exceptionally high value of 35 billion euros.

As a result, pension assets increased by 33 billion euros and amounted to 258 billion euros at the end of the year. The figures are preliminary at this point. The exact figures will be presented in June when a wider range of statistics on the money flow are available.

Economic growth reflected in investment returns and contribution income

The investment markets showed great profit in the second year of the corona pandemic. The growth in pension assets was driven, in particular, by stock market profits, resulting in improved solvency for earnings-related pension providers.

The insured wage sum of wage earners grew by an ample five per cent in 2021. The growth in wage sum and the end of the reduced contributions due to the pandemic increased the revenue of the earnings-related pension system by more than 2 billion euros from 2020.

The growth in expenditure slowed down temporarily, mainly as a result of the low inflation in 2020 via the earnings-related pension index. The reduced number of new disability pensions also curbed pension expenditure.

“The year 2021 reinforced pension financing in many ways. For example, private pension insurers collected around 6 billion euros in their joint buffer of stocks; the average solvency exceeded 136 per cent. This is good as the pension expenditure is predicted to grow steadily in the coming years and there is great uncertainty in the state of the economy,” explains actuarial manager Jaakko Aho (Finnish Centre for Pensions).

Pension system revenues for the private sector totalled 19 billion euros and expenditures 20 billion euros. Return on investment showed a profit of 22 billion euros. The corresponding figures for the public sector were slightly less than 11 billion euros in revenues and slightly more than 11 billion euros in expenditures, with a profit of 13 billion euros on investments.

Pension system revenues include pension insurance contributions, the Employment Fund’s share of earnings-related pension expenditures and state shares. Expenditures include pensions paid out, overall operating costs and taxes.

Read more

Cash flows of the earnings-related pension system

Pension assets and investment assets

Earnings-related pension assets are sometimes referred to as ‘pension assets’ and sometimes as ‘investment assets’. The difference stems from the fact that other receivables, debts and tangible assets are included in pension assets and reported in the balance sheet while these are excluded from investment assets. The investment assets of the Finnish earnings-related pension scheme at year’s end 2021 amounted to 225 billion euros.