Average monthly partial old-age pension 800 euros

Partial old-age pensions have been selected mainly by wage earners with an average income. As the retirement age rises, the pension cutting effect of the partial old-age pension increases. The increasing cutting effect of early retirement is already showing in starting old-age pensions.

The corona pandemic did not affect the number of new partial old-age pensions to any significant degree. In 2021, a total of 13,000 new partial old-age pensions started. The number of new pensions remained at the same level as in 2020.

At year-end 2021, a total of 31,600 persons received an old-age pension, which is around 2,500 persons more than in 2020. The number keeps rising, but at a slower pace than in the early days of the benefit. The growth is primarily due to the rising retirement age: the numbers grow as the partial old-age pensions are in payment for an increasingly longer period of time.

The longer periods on the partial old-age pension also affect the size of the final pension. As a rule, the partial old-age pension is drawn as soon as possible, at age 61. As the retirement age rises from one age group to another, the permanent decrease for early retirement grows.

The earlier a person takes out the partial old-age pension, the larger the permanent cut to the final pension will be.

In 2021, the youngest age cohort that could take out the partial old-age pension retired, on average, 41 months early. As a result, the paid-out pension (when taking out 50% of the earned pension) was reduced by more than 16 per cent, which means a permanent cut of 145 euros per month to the average pension”, explains development manager Jari Kannisto (Finnish Centre for Pensions).

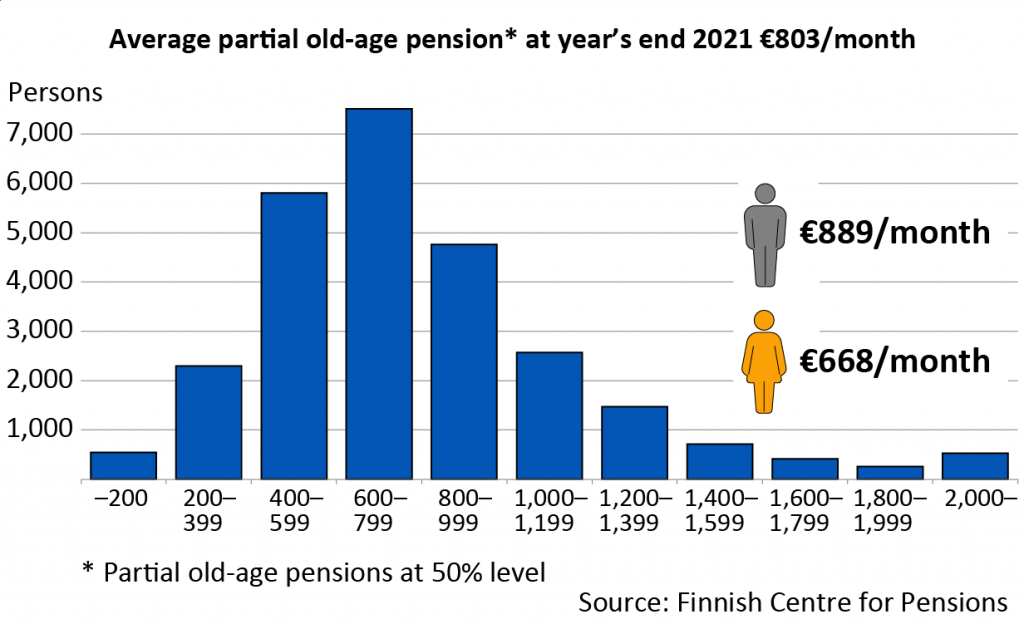

Men’s partial old-age pensions larger than women’s

Around 85 per cent of the partial old-age pensions in payment at the end of 2021 were taken out at the 50-per-cent level. On average, they amounted to 800 euros per month. The median monthly pension was 720 euros. Men’s average monthly pension (€890) was one third higher than women’s (€670).

As a rule, the partial old-age pension is taken out by private sector wage earners with an average income. More than half (58%) of the recipients of the partial old-age pension are men.

An ample two out of three partial old-age pension recipients continued working. Judging from the earnings level, an ample one third of those who have continued working have reduced their working hours. For others, the earnings level did not change or rose at least slightly.

Average monthly years-of-service pension 2,200 euros

The years-of-service pension came into force at the beginning of 2018. During the first four years, the pension has been drawn by 184 persons.

205 new years-of-service pensions began in 2021. They averaged nearly 2,180 euros per month. The majority of years-of-service pension recipients are men.

Read more

Partial old-age pension

- replaced the part-time pension in connection with the 2017 pension reform;

- offers a possibility for the 61-year-olds and older to take out a quarter (25%) or half (50%) of the pension they have earned so far;

- permanently reduces the full old-age pension by 0.4 per cent for each month that the pension is taken early;

- can be taken out late, after reaching the retirement age; if it is taken late, the share taken out is increased by 0.4% for each month that it is deferred;

- does not limit how much a person can work or earn; can be drawn by persons who are unemployed or working.

Years-of-service pension

- can be granted to workers aged 63 or more before the old-age pension;

- can be granted to persons who have done work that requires great mental or physical effort for at least 38 years;

- requires a medical statement that the worker’s ability to work has been reduced;

- amounts to the pension amount earned up to the time that the benefit is taken out;

- is paid until the recipient reaches their own retirement age.

Photo: Karoliina Paatos