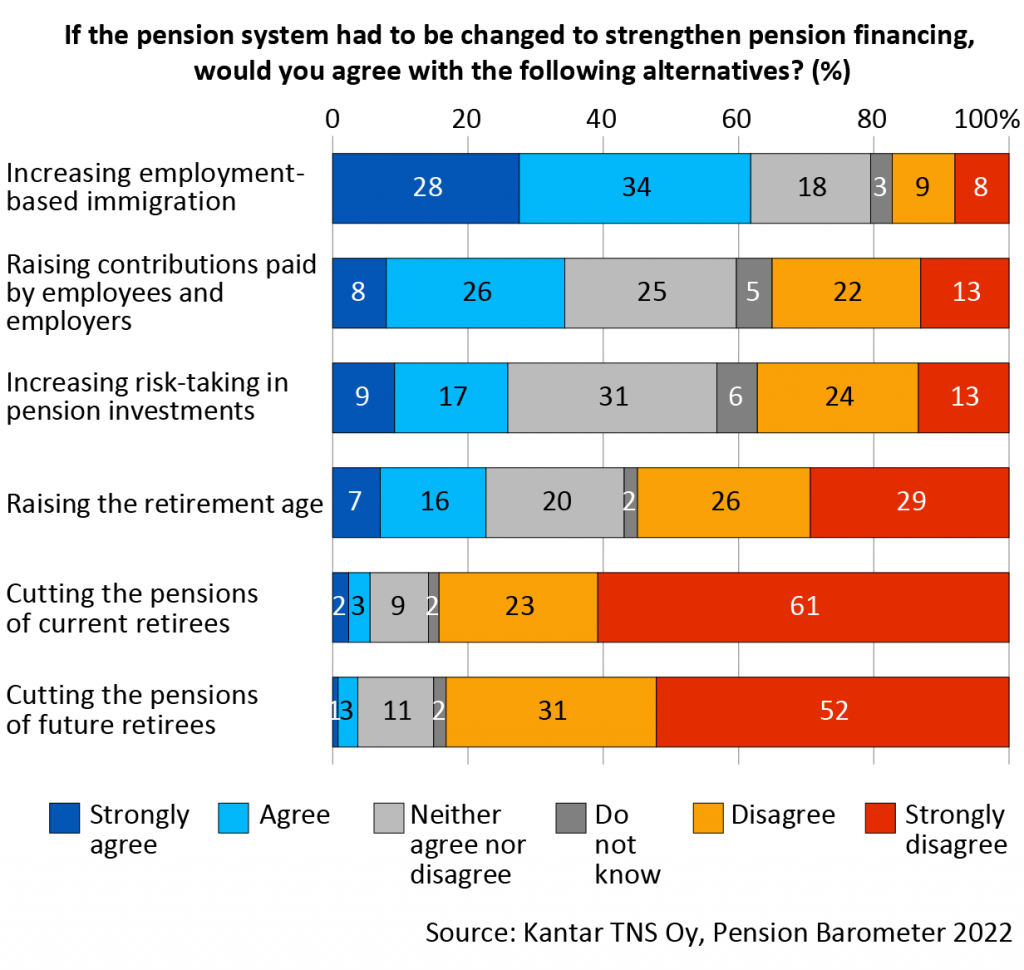

Immigration still the most popular solution to strengthen pension financing; one third would raise pension contributions

An ample 60 per cent of Finns find employment-based immigration to be a good means to strengthen pension financing.Raising pension contributions is the second most popular solution. An ample one third is in favour of this alternative. Only one quarter of Finns are in favour of pension investors increasing risk taking to increase pension assets. This is revealed by the latest Pension Barometer conducted by the Finnish Centre for Pensions.

Employment-based immigration as a means to strengthen pension financing increased in popularity by 10 percentage points compared to last year’s survey.

The second most popular alternative among the respondents is raising the pension contributions of the working-aged and employers. More than one third are in favour of this alternative. At the same time, one third of the respondents disagree or strongly disagree with this option.

Pension cuts are opposed the most. Up to 84 per cent disagree or strongly disagree with cutting pensions already in payment; 83 per cent oppose cutting the pensions of future retirees.

Increased risk-taking by pension providers polarises

Only every fourth respondent agrees or strongly agrees with the option of increasing pension assets by increasing risk-taking in pension investments. More than one third oppose this alternative. The under-50-year-olds are more favourable to this alternative than are the 50–64-year-olds. “It is slightly surprising that Finns don’t support achieving better returns by increasing risk-taking in pension financing although it could reduce the pressure to raise pension contributions,” says Director Allan Paldanius (Finnish Centre for Pensions).

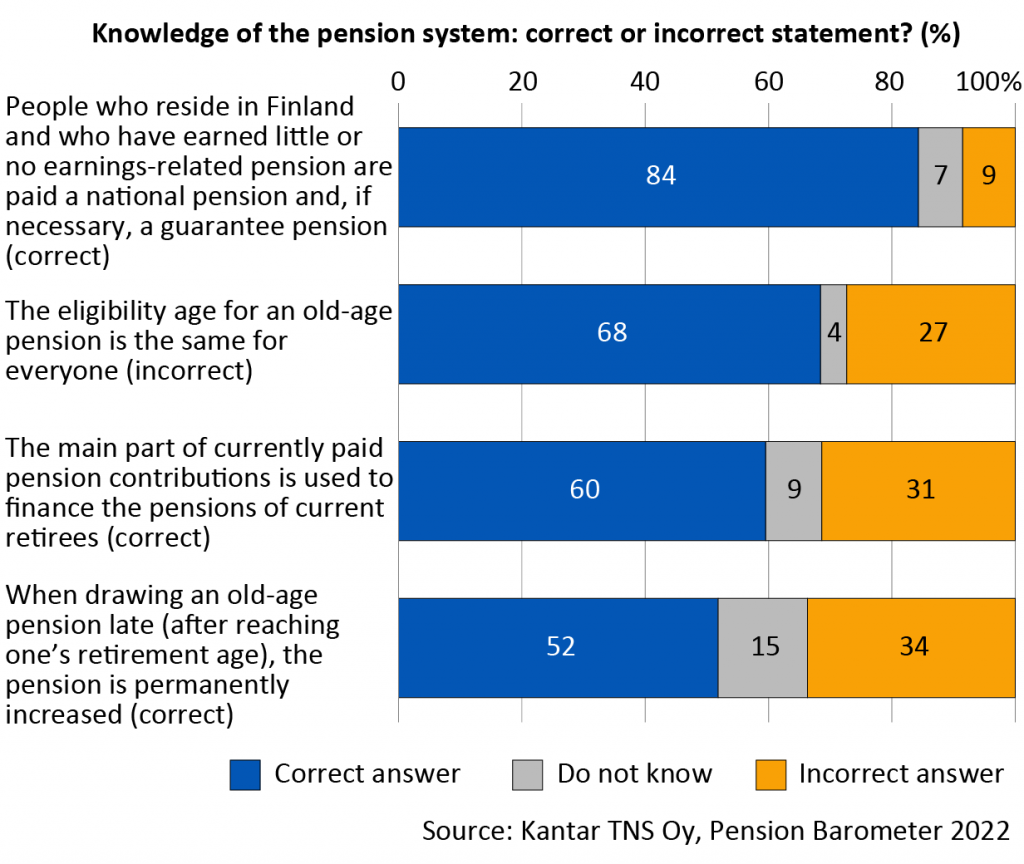

Increment for late retirement less well known

The survey contained statements that measured basic knowledge of pensions. The respondents are most familiar with the statement that a person who receives a low earnings-related pension is paid a national or guarantee pension. Around two out of three respondents know that the retirement age is not the same for all. More than one quarter of the respondents incorrectly believe that the retirement age is the same for all.

Sixty per cent know that the majority of paid pension contributions are used to finance current pensions in payment. Nearly every third respondent believes that this is not the case.

The effect of late retirement on the pension amount is least well known. Around one half of the respondents know that if they start drawing their pension after reaching their retirement age, their pension is permanently increased with an increment for late retirement. Slightly more than every third disagrees with this statement. “People are reasonably familiar with pensions. Ideally, as many as possible should know that retiring late improves their earnings-related pension. That way, everyone could make an informed decision on when to retire,” says Economist Sanna Tenhunen (Finnish Centre for Pensions).

Nearly three out of four trust the pension system

The Finns continue to trust the pension system. Around 70 per cent trust the Finnish pension system. Roughly as many find that the Finnish pension assets are managed reliably. Yet 54 per cent find that younger generations are overburdened with paying for pensions.

The survey was conducted in May 2022. The respondents numbered more than 1,000 Finnish citizens aged 18–79 years.