Cash flows of the earnings-related pension system

Examine the earnings-related pension money flows in the visualisation

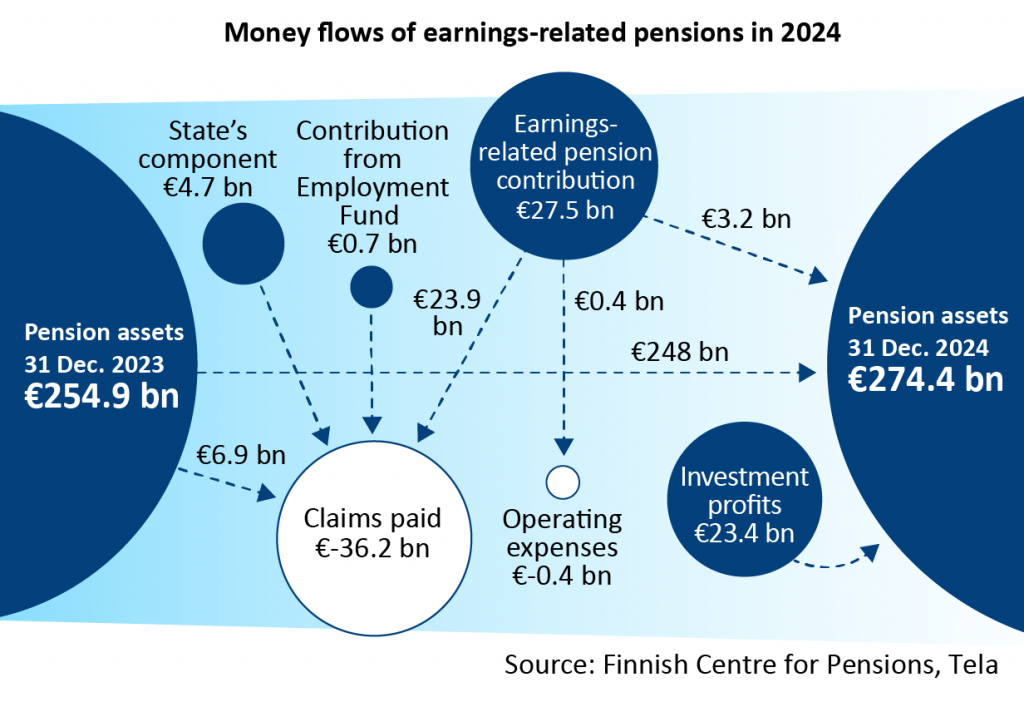

The earnings-related pension system’s assets increased in 2024 with 19.5 billion euros. Total assets at year-end were 274.4 billion euros.

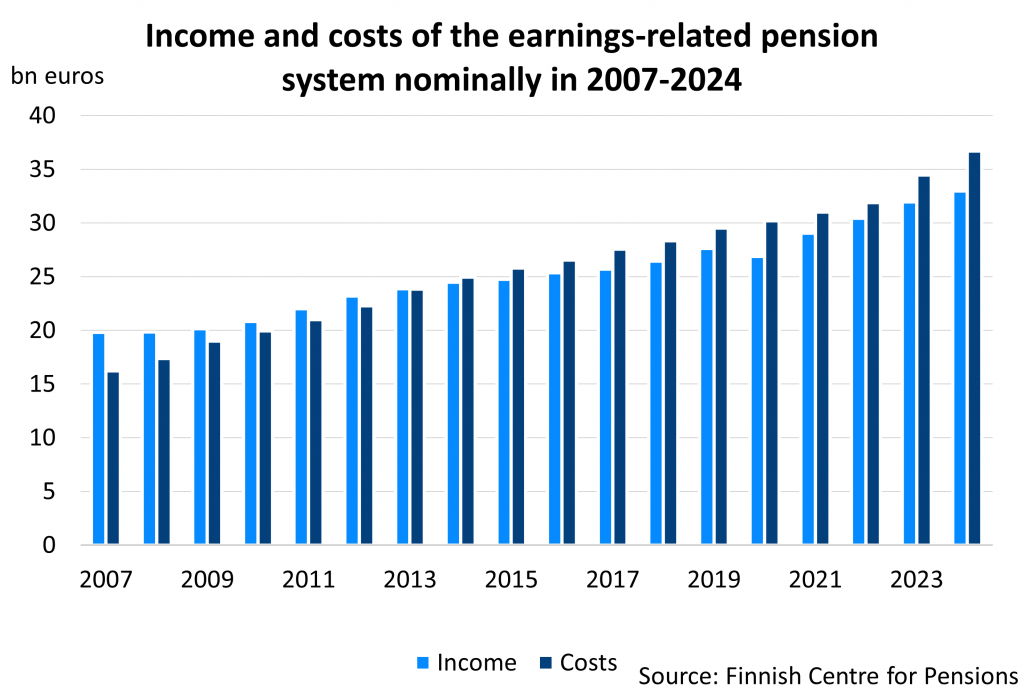

The increase in the assets is based on the investment profits. In 2024 income was 32.9 billion euros, costs 36.6 billion euros and the returns in the investment 23.4 billion euros.

The income of the private sector was 21.2 billion euros and costs 23.3 billion euros. The investment profits 14.4 billion euros. The income of the public sector was 11.7 billion euros and costs 13.4 billion euros, and the investment profits 9 billion euros.

(Updated on 3 June 2025)

Statistical tables:

Cash flows of the earnings-related pension system

Producer: Finnish Centre for Pensions

Website: Cash flows of the earnings-related pension system

Subject area: Financing and Insurance

Part of the Official Statistics of Finland (OSF): No

Description

In Finland employers, workers and the self-employed pay insurance contributions which are used to fund earnings-related pensions. In addition to pension assets and their investment returns, the Employment Fund and the State contribute to the financing of pensions. The figures in the tables give clearer picture how the finance of the pension system’s entity acts and how the figures of finance go together.

Data content

The table presents the cash flow of the earnings-related pension system for several different pension systems. In cash flow statistics, the annual review begins with the funds at the start of the year. Earnings are then added and expenditure subtracted, and the final sum is the assets at year-end.

The figures have been collected from the financial statement data of the pension providers and correspond to the figures available from the statistical database of the Finnish Centre for Pensions.

Categorizations

Pension scheme TyEL, MEL, YEL, MYEL, municipals, state, church, Kela and Bank of Finland.

Methods of data collection and source

The data is formed electronically from the Financial Supervisory Authority’s reports.

The financial statements of the pension providers.

Update frequency

Once a year.

Time of completion or release

In June following the statistical year.

Time series

The figures are available since 2007.

Key words

Pension assets, insurance contributions, state share, investment profits, claims paid, total operating expenses, taxes.

Concepts and definitions

The table contains information of pension assets, insurance contributions, contributions of the Employment fund, transfers, state shares, claims paid, overall operating costs and investments returns of the earnings-related pension system.

The figures correspond to the figures available from the statistical database of the Finnish Centre for Pensions.

Classifications

The cash flows are according to the pension scheme TyEL, MEL, YEL, MYEL, municipals, state, church, Kela and Bank of Finland.

The cash flow components

Pension funds

As pension funds of TyEL and MEL from beginning of 2013 have been used the sum of the solvency capital and technical provisions used in the solvency calculation, without the technical provisions according to the Self-Employed Persons’ Pensions Act (YEL). As pension funds of TyEL and MEL until 31.12.2012 have been used the sum of the solvency margin and technical provisions used in the solvency calculation, without the technical provisions according to the Self-Employed Persons’ Pensions Act (YEL) as reported in the financial statement.

By solvency margin is meant the difference of assets and liabilities valued at current value, by which the risks of investment operations are balanced. The technical provisions are formed from the mathematical provisions and the claims provision. The solvency calculation utilises technical provisions from which a share comparable to the provision for pooled claims and the provision for future bonuses has been deducted. As of beginning of 2013 the share comparable to the provision for pooled claims is not valid anymore. The solvency capital is the sum of solvency margin and equalisation provision. Technical provisions are used as pension funds for YEL and MYEL.

As pension funds for municipals (Local Government Pensions Act), a pension liability fund is used. The difference between the annual income and expenditure of Keva is added to the pension liability fund, or deducted from the pension liability fund. Assets not immediately used in pension payment are funded to cover future pension expenditure.

Investment assets calculated at current value are used as pension funds under state, church, KELA and BoF.

Insurance contributions

The insurance contribution income according to the financial statements contains the shares paid by both employer and employee as well as the insurance contributions paid by the self-employed. For the company pension funds, this is a contribution income accrued by contributions to the pension fund. The contribution is used to pay for both current and future earnings-related pensions, which is why part of the contribution is funded.

The following have been deducted from the insurance contribution income:

- bonuses and rebates

- credit losses from insurance contribution claims

- the share of reinsurance in the insurance contributions

TR contribution

The contribution of the Employment Fund is used to pay for costs incurred from the pension accrued from periods of unemployment and education, as well as based on benefits received during periods of job alternation leave. The Employment Fund pays the Finnish Centre for Pensions a contribution that the Finnish Centre for Pensions reimburses to the TyEL pension providers, the Seafarers’ Pension Fund, Keva, the Central Church Fund, the Social Insurance Institution (Kela), the Bank of Finland and the pension fund for the clergy of the Orthodox church. The Employment Fund also pays a separate contribution to the State Pension Fund.

Transfers

The transfers include a transfer fee paid by pension providers in the private sector to the state, which is determined when state agencies, institutions or public utilities become shareholding companies or if their operations are transferred to existing shareholding companies.

Transfers also include instalments realised from the receivership of Pension Kansa and the credit insurance surplus of the Finnish Centre for Pensions, as well as that received back from Garantia. These have been accounted to the Finnish Centre for Pensions and further refunded to the TyEL pension providers.

State share

The State annually participates in the funding of pensions under MEL, YEL, MYEL and state. According to the Seafarers’ Pensions Act, the State is liable to pay a third of the pension expenditure of those insured under said Act. Concerning the self-employed and farmers, the State pays only the share of pension expenditure which the insurance contributions of the aforementioned Acts are not sufficient to cover.

The pensions of State employees are paid from money set aside in the State budget. 60 per cent of all pensions paid are financed directly from the budget for each individual year. The State additionally compensates the pension providers for benefits from periods of study and childcare that are connected to earnings-related pensions.

Claims paid

Claims paid in accordance with the financial statements of the pension providers, without management expenses for claims settlements and the maintenance of working capacity, as well as clearing of PAYG pensions without the share in the TR (Employment Fund) contribution.

Total operating expenses

The total operating expenses are operating expenses included in different items of the profit and loss account, complete with scheduled depreciations. They are formed from claims settlement costs, administrative costs of maintaining working capacity, operating costs and other costs. Operating costs consist of acquisition and management costs of the insurance operations as well as administrative costs. Administrative costs comprise statutory contributions which are cost shares of the Finnish Centre for Pensions, the legal administration costs of the Pension Appeals Court and the supervision expenses of the Financial Supervisory Authority. Administrative costs of investment operations are not included in the overall operating costs, since they are included in the investment profits.

Investment profits

The profit from investment operations, at current value, is calculated by adding the difference between current and book value during the year to the investment profit of the profit and loss account and deducting the cost of investment operations, at book value, from the final sum. The change in the difference between current and book value forms part of a company’s investment results.

Administrative investment expenses are included when calculating the net profit of investment operations.

Other

The figure ‘Other’ is the result of differences in the statistics.