History of pension indexes

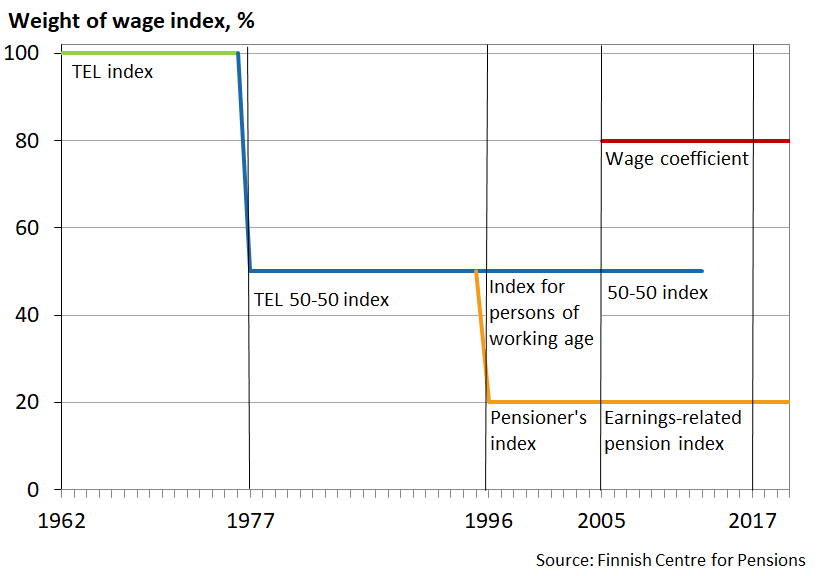

The private-sector earnings-related pension scheme came into force in 1962. Until 1976, the income while still working and the pensions in payment were linked to the TEL (Employees Pensions Act) index when determining the pension amount. A change in the TEL index was defined solely on the basis of a change in the wage earner’s earnings level. In public-sector schemes, the TEL index was introduced in the 1960s, which partly led to the need to reform the structure of the TEL index.

When the TEL index was applied to public-sector pensions with a aim of pensions being 66 per cent of the wages, excessively dimensioned pensions became a problem. It became evident through the fact that, after a few years in retirement, a public-sector retiree might get a pension that was almost equal to, or even higher than, the salary of the person hired to fill in the retiree’s position.

The problem was solved by applying the TEL 50-50 index as of the beginning of 1977, in which the weighting of the changes in price and earnings levels was 50 per cent. It was applied until 1995 both in the adjustment of earnings during the active years and all earnings-related pensions in payment.

During the period 1977-1984, earnings-related pensions were adjusted twice a year: at the turn of the year and at the beginning of July. The amount of the July adjustment was 40 per cent of the estimated adjustment of the following turn of the year.

As of the beginning of 1996, a new type of index scheme was introduced, in which earnings during working and pensions for those under the age of 65 were adjusted using the former 50-50 index, while the pensions of those who had turned 65 were adjusted with the pensioner’s index. When determining this index, the changes in price levels weighed 80 per cent while changes in earnings weighed 20 per cent. The scheme was applied to the end of 2004.

As of the beginning of 2005, an extensive earnings-related pension reform came into force. As a result, the provisions governing indexation were amended. Regardless of the age of the pension recipient and the starting date of the pension, all pensions in payment were adjusted with the earnings-related pension index, which is defined in the same way as the above-mentioned pensioner’s index.

The indexation for the active period was improved by introducing the wage coefficient at the same time as the average wage for the whole work history was introduced as the basis for the pension. When determining the wage coefficient, the change in price levels weighs 20 per cent while the change in earnings levels weighs 80 per cent.

Earnings-related pension scheme indexes as of 1962, according to the weighting of the index of wage and salary earnings