Supplementary Pensions

As a result of the 2017 pension reform, the age limit for voluntary pension insurance has risen and is the same as the age at which the insurance obligation for the birth year in question ends.

| Year of birth | Age when insurance obligation ends |

|---|---|

| 1957 or earlier | 68 years |

| 1958-1961 | 69 years |

| 1962- | 70 years |

The tax benefit for the contributions for voluntary pension insurance and long-term savings accounts that have begun before 2013 follow former rules. The age limit for the tax benefit of the contributions for voluntary pension insurance rose to 68 years already as of the beginning of 2013.

The rising age limit applies also to group supplementary pension policies if the employee pays part of the contribution. If the employer pays the total contribution, the pension may begin earlier. Pension received from a supplementary pension arranged by the employer is taxed as earned income.

Supplementary pensions complement statutory pensions

In accordance with the traditional international classification, pension provision is divided into three pillars.

First pillar pensions are statutory pensions. In Finland, such pensions are the national and the earnings-related pensions.

Second-pillar pensions are collective industry- or employer-specific pension schemes. In Finland, such schemes include group pension insurance arranged by the employer.

Third-pillar pensions are private, voluntary pensions. In Finland, they may be individual pensions or long-term saving accounts. People may prepare for their retirement also by saving in other ways.

The significance of supplementary pensions increases if the income in retirement would be low otherwise due to, for instance, long periods of study, unemployment or child care. In addition to raising the level of income in retirement, voluntary supplementary pension provision sometimes offers the possibility to retire before reaching the retirement age.

Role of supplementary pensions in Finland

Contrary to the case in many other countries, the role of third-pillar supplementary pensions is not very significant in Finland. Statutory pensions are broad in scope, and neither the pensionable earnings nor the pension amount have a ceiling.

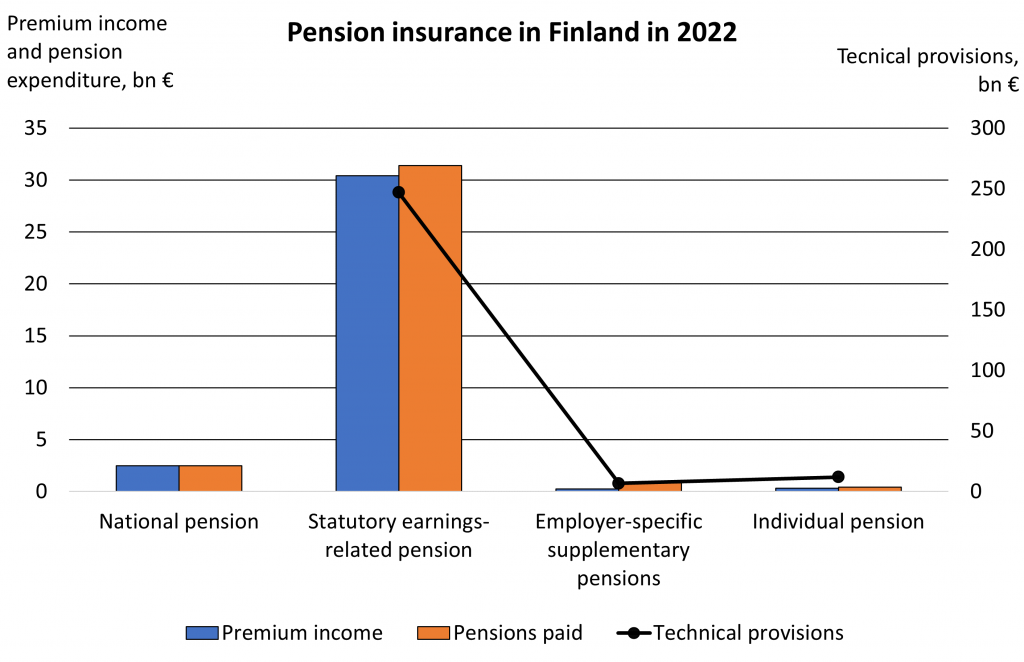

In international comparison, the share of supplementary pension provision of the total pension provision is small. Viewing from the point of view of pension contributions, the total pension provision consists to 95 per cent of statutory pensions and to 5 per cent of supplementary pensions.

The premium income of the national pension includes only pensions (not, for example, housing and disability benefits).

Source: Kela and Financial Supervisory Authority

Employer arranges collective occupational pensions

Employers in Finland may arrange occupational pension provision for their employees through either a group or an individual pension insurance.

The group pension insurance is collective and requires that the persons covered by the insurance are selected objectively on the basis of, for example, their job tasks or occupational status. If the intention is to target the occupational pension insurance at a specific person, the employer has to take out individual pension insurance for the employee in question.

In practice, the group pensions arranged by private employers for their employees are free-form occupational pensions. As a rule, free-form group pension insurance includes only old-age pension, but disability and survivors’ pensions may also be incorporated in the pension provision.

As a rule, free-form group pension insurance policies include vested rights, that is, the right to the accrued occupational pension even after the employment contract has ended. The entitlement to a vested pension may be dependent on, for instance, the length of the employment contract. It may also be partial, for example, 50 per cent of the accrued occupational pension. If there is no right to a vested pension, the employee loses their occupational pension benefit when they change employer or are fired.

Administration and supervision of group pensions

Group pension insurance may be arranged with an industry-wide or a company pension fund or a life insurance company. Voluntary group pension insurance may also be based on the company’s own pension regulation. In that case, it is not an insurance policy but a book reserve, where the employer is committed to paying pensions to a defined group of persons.

The Financial Supervisory Authority supervises pension providers and funds in the insurance industry in Finland.

More on other sites

Structure of group pensions

Group pension insurance must cover a collective group of people which includes at least two people. The insured group can be defined on the basis of, for example, the employee’s occupational status, profession, line of industry, establishment, date that the employment began, time of birth, other pension provision arranged by the employer or transfer of activities.

The occupational pension paid from the group pension insurance is typically either a supplemental occupational pension paid out to the employees or a pension with the intention to lower the employees’ retirement age. The insurance may also be a combination of the two.

The retirement age of occupational pensions is the same as the age at which the age group’s insurance obligation ends.

| Year of birth | Age when insurance obligation ends |

|---|---|

| 1957 or earlier | 68 years |

| 1958-1961 | 69 years |

| 1962- | 70 years |

The same age limits apply to collective occupational pensions if the employer pays part of the insurance contributions. If the employer pays the total contribution, the retirement age may be lower.

In group pension insurance policies, the lowest possible retirement age that entitled to tax deductions of the contributions used to be 55 years. If the employer paid part of the contributions, the retirement age used to be 60 years.

Under certain circumstances, due to the transition regulations of the 2005 and 2017 pension reforms, it has been possible to get a statutory basic pension before the statutory retirement age if the retirement age of the free-form occupational pension was lower than that. The pension is reduced for early retirement. If the lower retirement age is below the retirement age for statutory old-age pension, the income during the retirement years without a statutory pension are in their entirety financed through the occupational pension.

Determining the pension benefits

The group pension may be a defined-benefit or a defined-contribution pension. In a defined-benefit arrangement, a certain benefit level has been determined for the employee, for example, an old-age pension that is 66 per cent of the wage at the agreed retirement age.

In a defined-contribution scheme, only the contribution level is defined, and the occupational pension that will be paid is determined on the basis of the accumulated savings. For example, the contribution may be defined as a fixed percentage of the employee’s wage or be linked to the company’s profits.

Nowadays, almost all new group pensions are defined-contribution schemes. Former defined-benefit arrangements have also been converted to defined-contribution arrangements.

The annual index security for occupational pensions in payment can be arranged in very many different ways but, as a rule, occupational pensions are adjusted with either the earnings-related pension index or based on customer bonuses and rebates paid by life insurance companies.

Financing and taxation

Group pension insurance contributions in their entirety are deductible expenses for the company. In contrast to private pension insurance, the annual pension contributions have no maximum amount, as long as the purchased occupation pension provision is at a reasonable level according to the tax authorities.

Group pension insurance contributions are not considered income for the employee, and thus the employer does not have to withhold preliminary taxes on them, nor pay social insurance contributions for them. The occupational pension paid in due course to the pension recipient is taxed as earnings.

The employee may pay part of the pension contributions. At the most, the contribution may amount to half of the annual contribution. If the insured pays part of the contribution, they may deduct the contributions they have paid in their income taxation to a maximum of five per cent of the wage that the employer in question has paid to him. In euros, the deduction may amount to 5,000 euros per year at the most.

Registered group life insurance

Registered group life insurance policies under the Employees’ Pensions Act (TEL) arranged by the employer ended on 31 December 2016. At the same time, the obligation to pay contributions ended and pension no longer accrued.

Before the year 2001, group life insurance policies arranged by private employers for their employees were either registered or free-form policies. In the early days of the statutory earnings-related pension scheme, private employment relationships often came with a registered occupational pension since the coverage would have been very low otherwise.

Registered occupational pension schemes were closed as of the beginning of 2001. It has not been possible to register new occupational pensions since then. Those who were already covered by the scheme retained their right to the occupational pension and to a continued insurance.

Abolishing the occupational scheme under TEL does not affect pensions in payment or the amount of occupational pension that an employee had earned before the scheme was abolished.

Taking out a registered occupational pension has been optional, but the content and operations of the schemes have been regulated by law. For example, they are linked to the indexation of the earnings-related pension schemes.

If the registered occupational pension scheme includes an old-age pension, it also includes a disability pensions. A supplementary survivors’ pension and a funeral grant may be included in the old-age pension or, alternatively, the occupational pension may include only these two benefits. The employee automatically retains the right to the earned occupational pension when the employment relationship ends.

Due to the transition rules in relation to the 2005 and 2017 pension reforms, and under certain conditions, it is possible to get an early statutory basic pension before one’s retirement age if the registered occupational pension comes with a lower retirement age.

Self-employed persons have also been able to take out a registered occupational pension. The self-employed has then been the sole beneficiary of such a supplementary benefit. There are no continuing registered occupational pensions anymore. Based on insurance policies that have ended, a self-employed person who retires can be granted an occupational pension.

Registered occupational pensions are administered by earnings-related pension insurance companies.

Coverage

At the moment, nearly every fourth person who gets a private sector earnings-related pension gets an occupational pension (either free-form or registered occupational pension). The occupational pensions are very small, though. Group pensions make up less than four per cent of pensions paid.

Individual pension insurance and long-term saving

Supplementary pensions may be accrued individually by taking out a voluntary pension insurance or by signing a long-term savings contract.

The individual pension insurance may be taken out by the insured person or by the insured person’s spouse or employer. If the employer is the policyholder, the insured may not pay contributions to the insurance. A long-term savings account can be signed only by a natural person.

According to the Insurance Supervisory Authority, the number of individual pension insurance policies at the end of 2019 amounted to approximately 611,000 and the surrender value of the pension savings was approximately 11 billion euros. Individual pension insurance policies have lost popularity in recent years; the number of new policies has declined compared to previous years.

As a result of the 2017 pension reform, the age limit for voluntary pension insurance has risen and is the same as the age at which the insurance obligation for the birth year in question ends.

| Year of birth | Age when insurance obligation end |

| 1957 or earlier | 68 years |

| 1958-1961 | 69 years |

| 1962- | 70 years |

The pension contributions of voluntary pension insurance and long-term savings contracts made before 2013 are tax-deductible according to former rules. The age limits for the tax reduction rose to 68 years already at the beginning of 2013.

The insurance can be agreed to be either a fixed-term or a lifelong insurance. The majority of individual pension insurances are fixed-term.

An individual pension is not a hindrance for employment, and some of the persons drawing an individual pension are still in active employment. Usually, the insurance contract also includes life insurance provision for the event of the death of the insured person. In that case, the insurance savings are paid in predetermined parts to the insured person’s beneficiaries.

Savings returned in exceptional cases

The right of termination of an individual pension insurance and a long-term savings contract is limited. The individual pension insurance policy may be drawn on early in case of permanent disability. In case of unemployment that lasts for more than one year, the insured may draw the surrender value of the insurance policy, less the administrative costs.

The termination practice differs from one company to another. In general, individual pension insurance policies which can be drawn on early on the basis of disability or unemployment presuppose that the insurance savings are covered by life insurance.

Individual pension insurance taken out by the employer for the employee does not necessarily include vesting of pension rights if the employment contract ends before the employee reaches their retirement age.

Determining the pension

The pension according to an individual pension insurance contract or a long-term savings contract which will become payable in due course is determined on the basis of the accumulated savings, that is, the paid contributions and their return. An individual pension insurance may be interest rate-linked or investment-linked.

The return on interest rate-linked pension insurance consists of the technical interest rate and a separate additional interest rate determined on the basis of the insurance company’s profit.

The return on investment-linked insurance is determined on the basis of the development of the value of the funds chosen by the policyholder. The risk of the return on and the maintenance of the insurance capital in investment-linked insurance is carried by the client. In contrast to bank deposits, the capital has no statutory deposit guarantee.

According to Finance Finland, individual pension insurance policies had accumulated insurance savings to a total of 320 million in 2018. Of this amount, 79 per cent were paid into return-on-investment-linked insurance policies and 21 per cent to interest-linked policies.

More on other sites